STAMP TAXES

Stamp duty is payable at a rate of 0.5% on certain transfers of shares

and securities of £1,000 and over.

The incremental rate of stamp duty land tax is only payable on the

part of the property price within each land tax band.

n

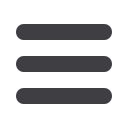

Stamp duty land tax

On the transfer of residential*

property

On the transfer of non-residential

property

Less than £125,000

0% Less than £150,000

0%

From £125,001 to

£250,000

2%

From £150,001 to

£250,000

2%

From £250,001 to

£925,000

5% Over £250,000

5%

From £925,001 to

£1,500,000

10%

Over £1,500,000

12%

Over £500,000

15%**

* Additional 3% rate applies to second properties over £40,000.

** For purchases by companies and other certain non-natural persons,

subject to certain exclusions.

n

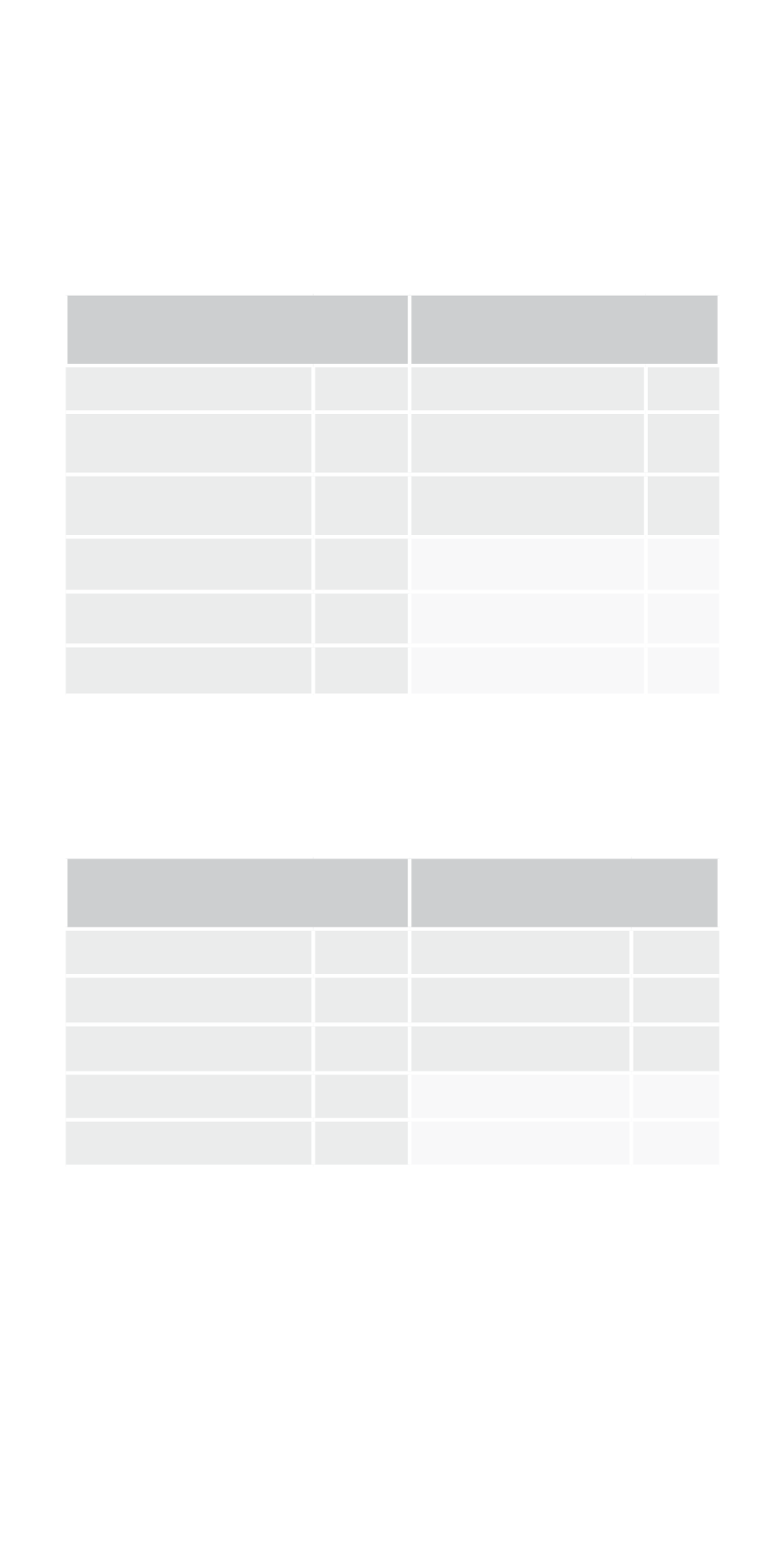

Land and buildings transaction tax in Scotland

On the transfer of residential*

property

On the transfer of non-residential

property

£0 - £145,000

0%

£0 - £150,000

0%

£145,001- £250,000

2%

£150,001- £350,000

3%

£250,001 - £325,000

5% Over £350,000

4.5%

£325,001 - £750,000

10%

Over £750,000

12%

* Additional 3% rate applies to second properties over £40,000.