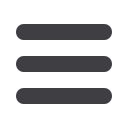

CAPITAL GAINS TAX

2017/18

2016/17

Main rates

Individual basic rate

10% 10%

Individual higher rate

20% 20%

Trusts and estates

20% 20%

Gains on

residential

property not

eligible for

PPR relief and

carried interest

Individual basic rate

18% 18%

Individual higher rate

28% 28%

Trusts and estates

28% 28%

Annual

exemption

Individuals

£11,300 £11,100

Trusts

£5,650

£5,550

Entrepreneurs’

relief

Applicable rate

10% 10%

Lifetime limit

£10m £10m

Investors’ relief

Applicable rate

10% 10%

Lifetime limit

£10m £10m

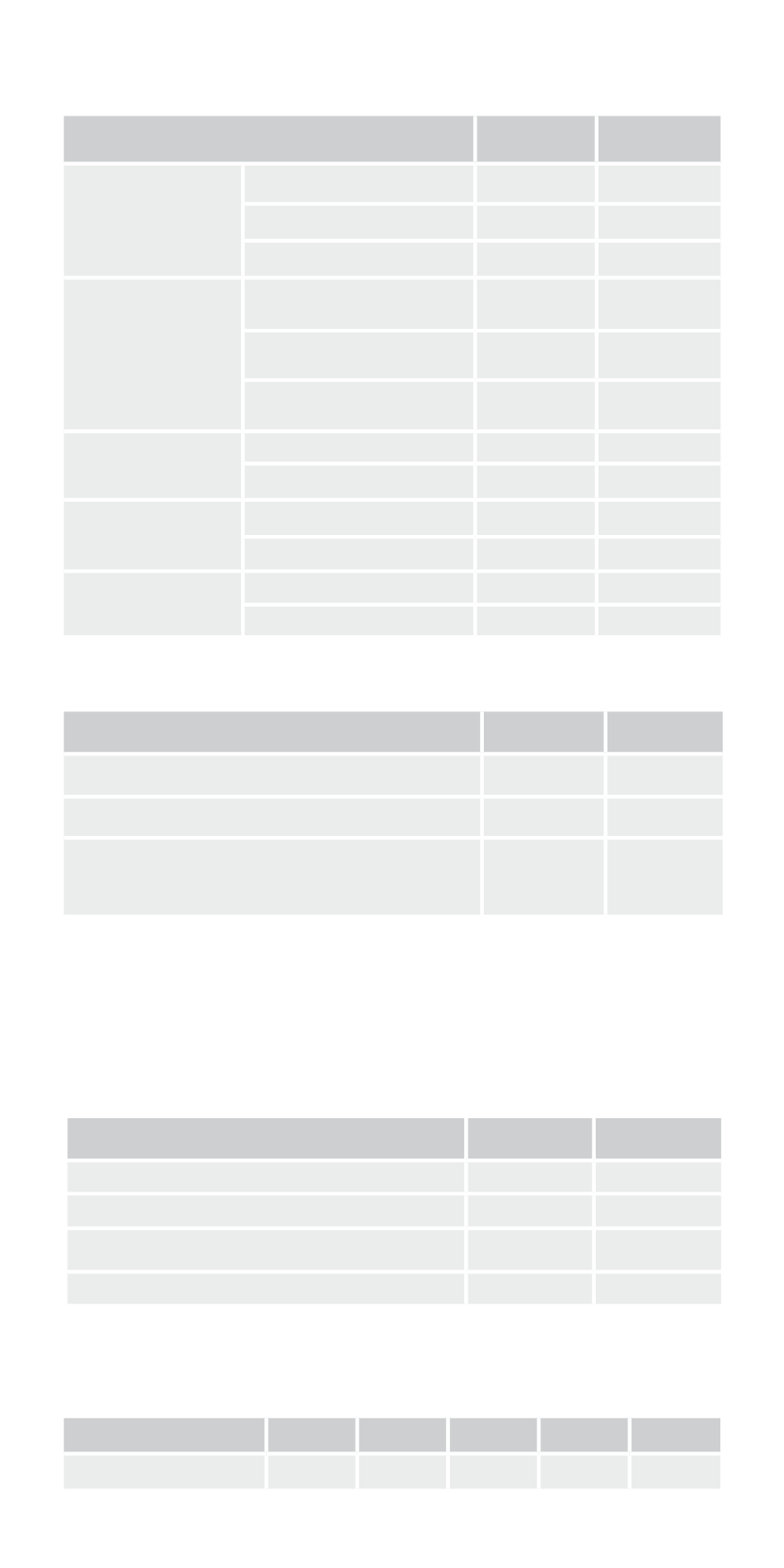

INHERITANCE TAX

2017/18

2016/17

Nil-rate band threshold*

£325,000 £325,000

Main residence nil-rate band**

£100,000

N/A

Combined threshold limit for married

couples and civil partners, including

main residence nil-rate band

£850,000 £650,000

* Up to 100% of any unused part of a deceased person’s nil-rate band can

be claimed by the surviving spouse/civil partner on their death.

** For estates worth in excess of £2m, the additional main residence

nil-rate band will be tapered at a withdrawal rate of £1 for every £2 over the

threshold.

n

Tax rates

2017/18

2016/17

Main rate

40% 40%

Chargeable on lifetime transfers

20% 20%

Transfers on or within 7 years of death*

40% 40%

Reduced rate**

36% 36%

* All lifetime transfers not covered by exemptions and made within 7 years

of death will be added back into the estate for the purposes of calculating

the tax payable. This may then be reduced as shown in next the table.

** Applies if 10% or more of net estate given to charity.

Years before death

0-3

3-4

4-5

5-6

6-7

Tax reduced by

0% 20% 40% 60% 80%

Contact us about exemptions.