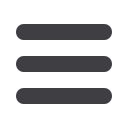

NATIONAL INSURANCE

Class 1

Employee

Employer

Earnings per week

Up to £157

nil*

Up to £157

0%

From £157.01 to

£866

12% Over £157

13.8%**

Over £866

2%

Over state

pension age

0%

Over state

pension age

13.8%

* Entitlement to contribution based beneits are retained for earnings

between £113 and £157 per week.

** 0% for employees under 21 and apprentices under 25 on earnings up to

£866 per week.

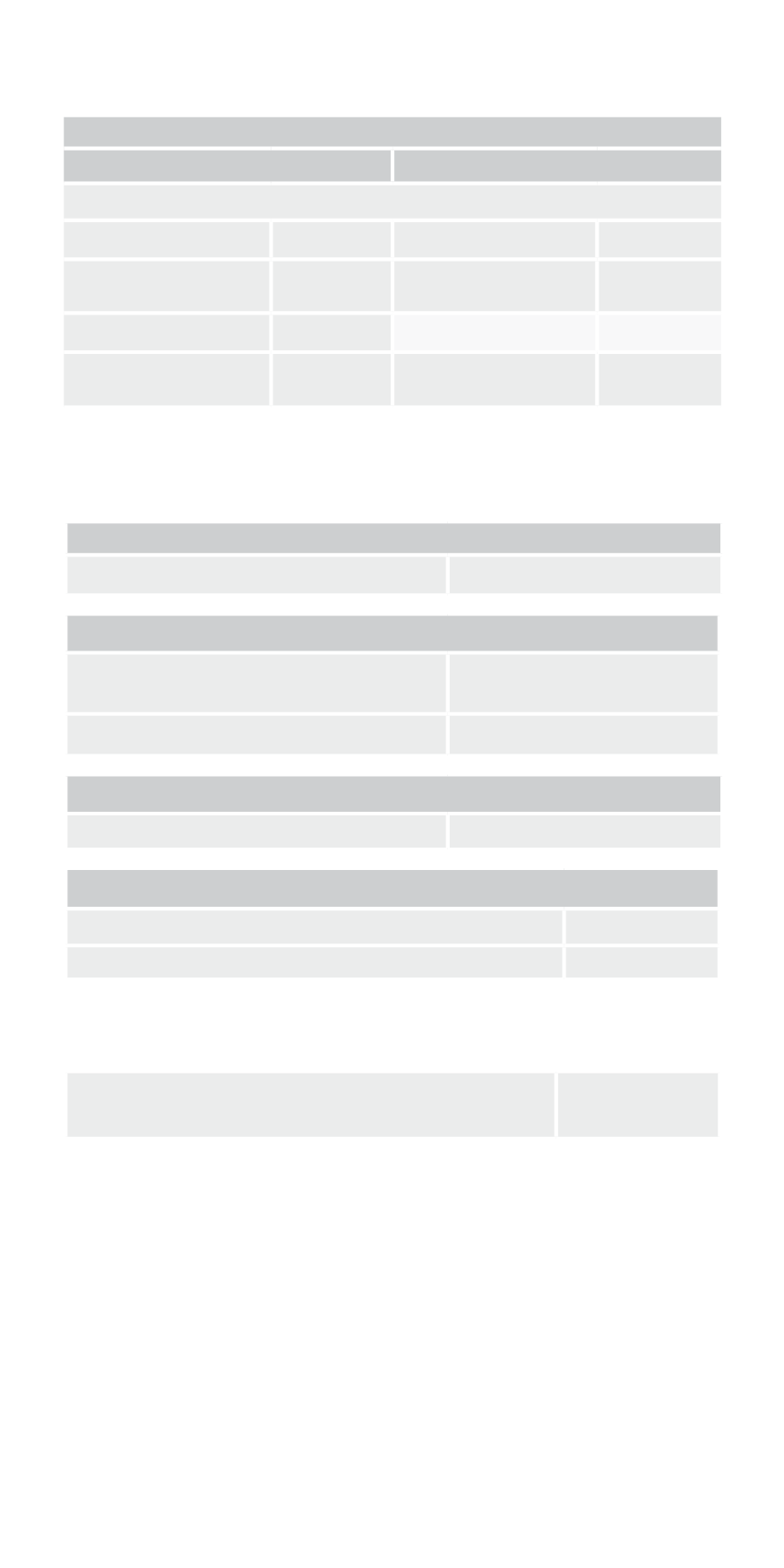

Class 1A

On relevant beneits

13.8%

Class 2

Self-employed above small proits

threshold

£2.85 per week

Small proits threshold

£6,025 per annum

Class 3

Voluntary

£14.25 per week

Class 4*

Self-employed on proits £8,164-£45,000

9%

Over £45,000

2%

* Exemption applies if the state retirement age is reached by 6 April 2017.

n

Employment allowance

Per employer, per year

(excluding 1 person companies)

£3,000*

* 1 claim only for companies in a group or under common control. Not

available where the director is the only employee paid earnings above the

secondary threshold for class 1 national insurance contributions.

IMPORTANT NOTICE

These rates and allowances are based on Budget 2017 and are for

information only. They are subject to conirmation by the Finance Act 2017.

Rates apply to the UK unless where indicated otherwise.

Contact us to discuss your planning.

n

Apprenticeship levy

A levy of 0.5% applies where the payroll exceeds £3 million. There is

an allowance of £15,000. Further conditions apply so please consult

with us.