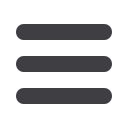

TAXABLE INCOME BANDS AND TAX RATES

2017/18

2016/17

Starting rate of 0% on

savings up to

£5,000*

£5,000*

Basic rate band

Scottish basic rate band

£33,500

£31,500

£32,000

£32,000

Higher rate band

Scottish higher rate band

£33,501-£150,000

£31,501-£150,000

£32,001-£150,000

£32,001-£150,000

Basic rate

20%

20%

Higher rate

40%

40%

Additional rate

45%

45%

Additional rate band

Over £150,000

Over £150,000

Dividend ordinary rate

7.5%

7.5%

Dividend upper rate

32.5%

32.5%

Dividend additional rate

38.1%

38.1%

* The starting rate does not apply if taxable non-saving income exceeds the

starting rate limit.

n

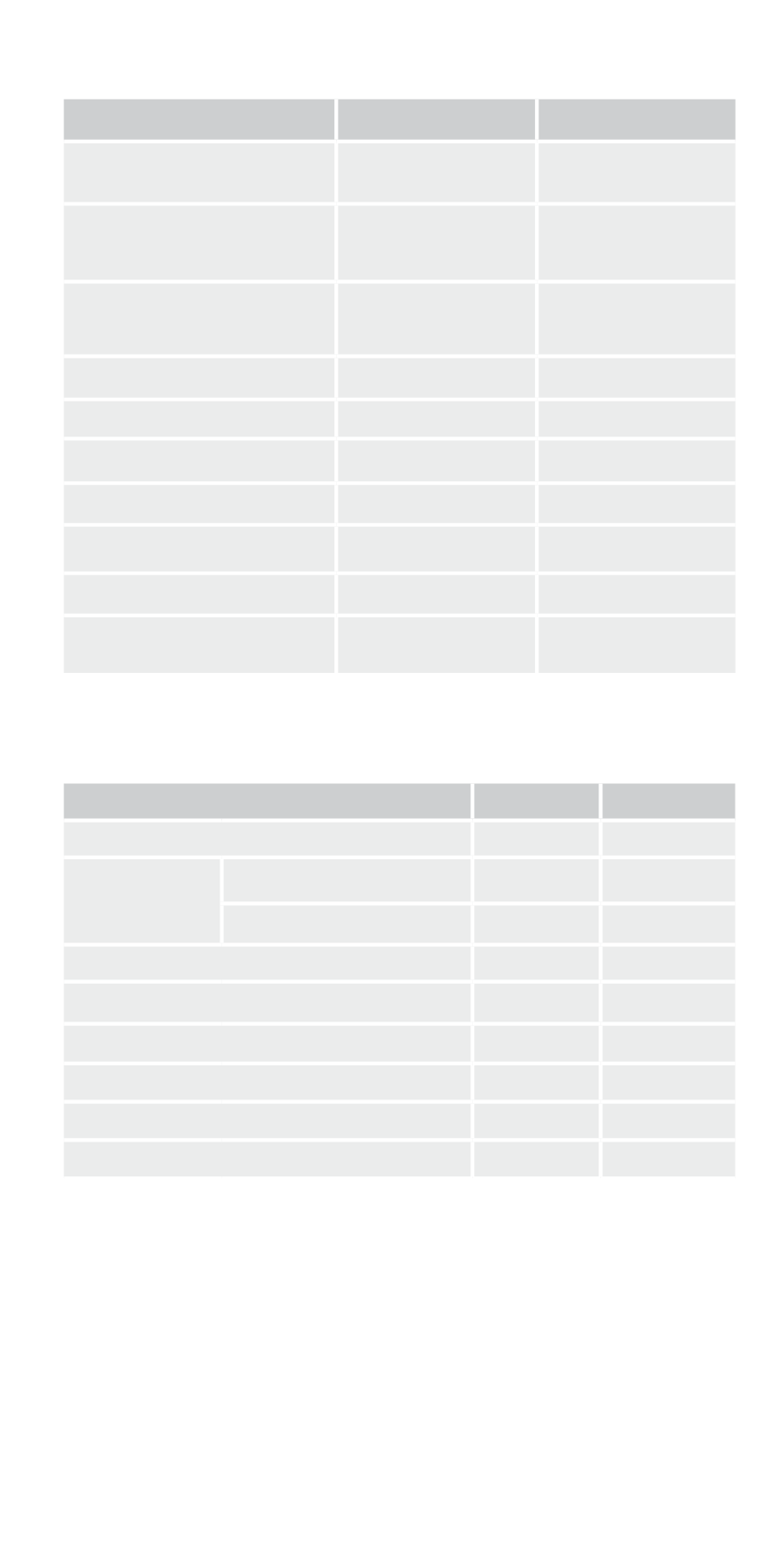

Allowances that reduce taxable income or are not taxable

2017/18

2016/17

Personal allowance*

£11,500

£11,000

Personal

savings

allowance

Basic rate taxpayer

£1,000

£1,000

Higher rate taxpayer

£500

£500

Dividend allowance

£5,000

£5,000

Marriage allowance**

£1,150

£1,100

Trading allowance***

£1,000

N/A

Property allowance***

£1,000

N/A

Rent a room allowance

£7,500

£7,500

Blind person’s allowance

£2,320

£2,290

* The personal allowance is reduced by £1 for each £2 of income from

£100,000 to £123,000 (2016/17, £122,000).

** Available for basic rate taxpayers.

*** Note that landlords and traders with gross income from this source in

excess of £1,000 can deduct the allowance from their gross income as an

alternative to claiming expenses.