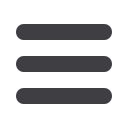

REGISTERED PENSIONS

Lifetime allowance limit

£1,000,000

Annual allowance limit

£40,000*

Money purchase annual

allowance

£4,000 (2016/17, £10,000)

Individuals

£3,600 or 100% of net relevant

earnings to £40,000*

Employers

£40,000* less employee contributions

Minimum age for accessing beneits

55

On cumulative beneits exceeding

£1,000,000

* Tapered at a rate of 50% of income > £150,000 where income plus

employer contributions exceeds £150,000 and income exceeds £110,000.

The unused amount of the annual allowance can be carried forward up to

3 years and used once the current year annual allowance has been fully

utilised.

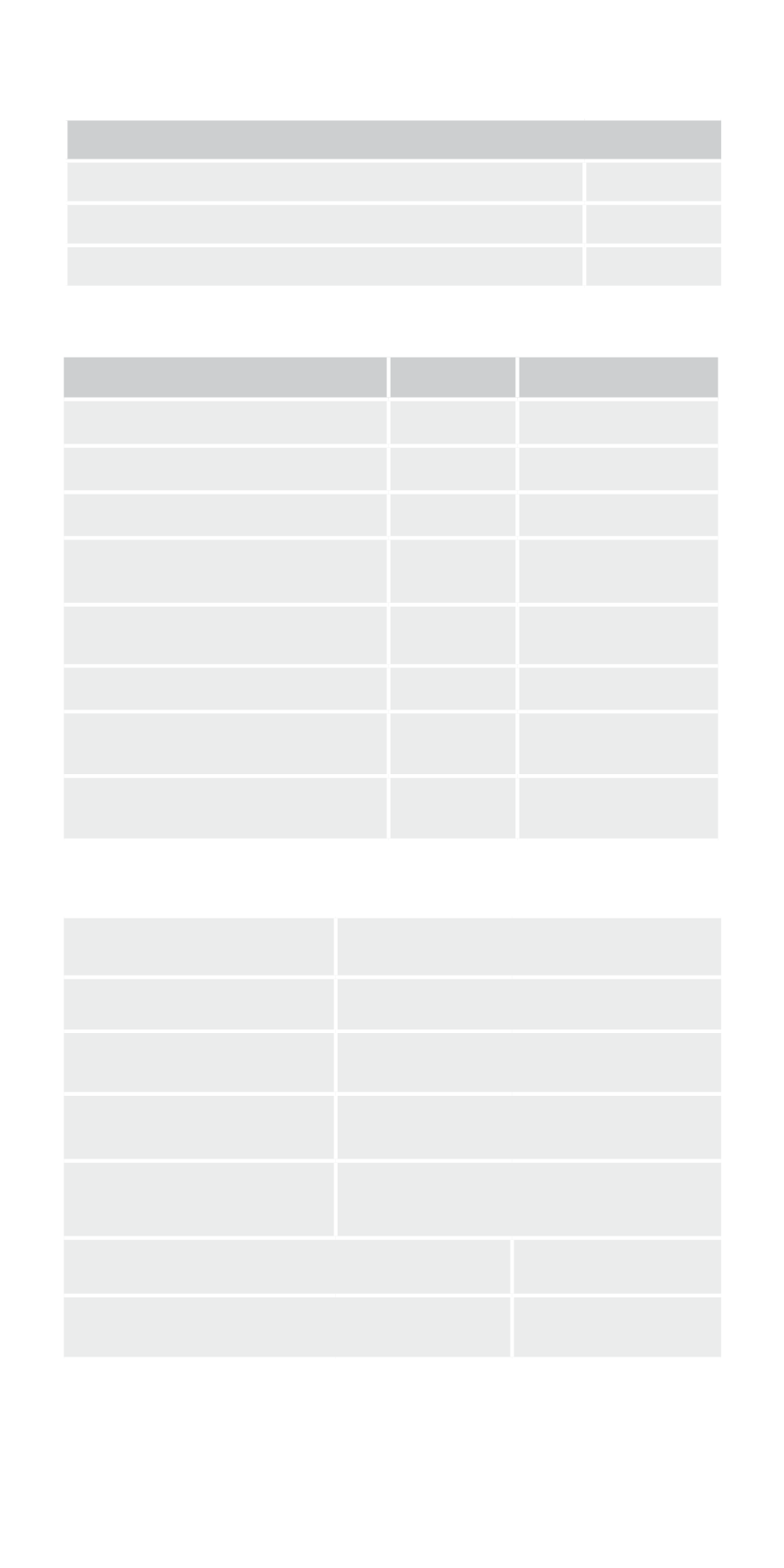

TAX INCENTIVISED INVESTMENT

Annual investment limit

2017/18

2016/17

ISA

£20,000

£15,240

Lifetime ISA

£4,000

N/A

Junior ISA and Child Trust Fund £4,128

£4,080

Venture Capital Trust at 30% £200,000

£200,000

Enterprise Investment Scheme

(EIS) at 30%

£1,000,000

£1,000,000

Seed EIS (SEIS) at 50%

£100,000

£100,000

SEIS capital gains tax

investment relief

50%

50%

Social investment tax relief

at 30%

£1,000,000

£1,000,000

RESEARCH AND DEVELOPMENT COSTS

Research and development (R&D)

Revenue expenditure - SMEs

230%

Large company R&D taxable expenditure credit

11%

Capital expenditure - all companies

100%