n

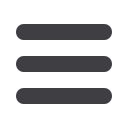

Allowances that reduce tax

2017/18

2016/17

Married couple’s allowance

(MCA) tax reduction

£844.50

£835.50

Available to people born before 6 April 1935. The age for MCA is that of

the elder spouse or civil partner. The loss of tax reduction is 10p for each

£2 of income above £28,000 (2016/17, £27,700) until £326 (2016/17, £322)

is reached.

n

High income child beneit charge

2017/18

2016/17

Threshold

£50,000

£50,000

There is a tax charge of 1% of the child beneit received for each £100 that the

threshold is exceeded up to a maximum of 100%.

TAX-FREE MILEAGE ALLOWANCES

Cars and vans

First 10,000 business miles

45p

Thereafter

25p

Motorcycles

24p

Bicycles

20p

Business passenger

5p

For national insurance purposes: 45p for all business miles for cars and vans.

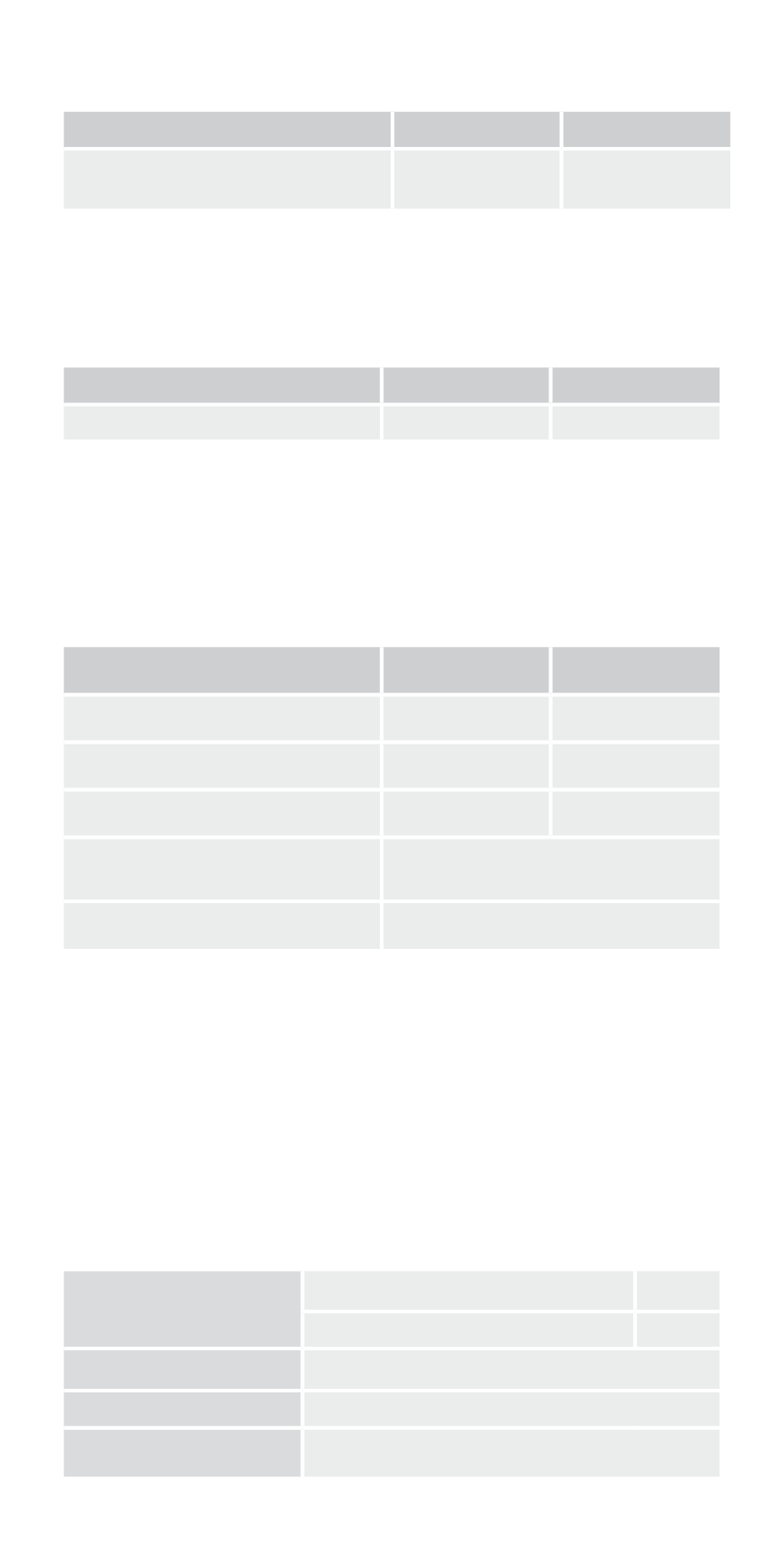

VEHICLE AND FUEL BENEFITS IN KIND (BIK)

The taxable BIK is calculated as a percentage of the car’s UK list

price. The percentage depends on the car’s CO

2

emissions in grams

per kilometre (g/km).

Emissions

Petrol

Diesel

0 – 50g/km

9%

12%

51 – 75g/km

13%

16%

76 – 94g/km

17%

20%

Over 94g/km

add 1% for every 5g/km or part

thereof

190g/km* and over

37% maximum

* Over 174g/km for diesel.

The list price is on the day before irst registration, including most

accessories and is reduced by any employee’s capital contribution (max

£5,000) when the car is irst made available.

Where the cost of all fuel for private use is borne by the employee, the fuel

beneit is nil. Otherwise, the fuel beneit is calculated by applying the car

beneit percentage (above) to £22,600 (2016/17, £22,200).

Vans where private use is more than home to work travel; £3,230 (2016/17,

£3,170) beneit and £610 (2016/17, £598) for private fuel. Payments by

employees for private use may reduce these BIK. Vans with zero emissions

have a beneit of £646 (2016/17, £634).