17

Tax relief on personal pensions

Premiums on personal pension policies are payable net of

basic rate tax relief at source, with any appropriate higher or

additional rate relief usually being claimed via the PAYE code or

self assessment Tax Return.

Case Study

Francesca will earn £60,000 in 2018/19. She will invest

£12,500 into her personal pension policy. She is entitled to

the basic personal allowance and has no other income.

Francesca will pay her pension provider a premium, net of

basic rate tax relief of £10,000. She is also entitled to higher

rate tax relief on the gross premium, amounting to £2,500.

As Francesca is an employee, we can ask HMRC to give the

relief through her PAYE code. Otherwise, we would claim in

Francesca’s 2019 Tax Return. Thus the net cost to Francesca

of a £12,500 contribution to her pension policy is just £7,500.

With new income tax rates being introduced in Scotland, this

issue is more complicated for Scottish taxpayers. Contact us for

specific advice.

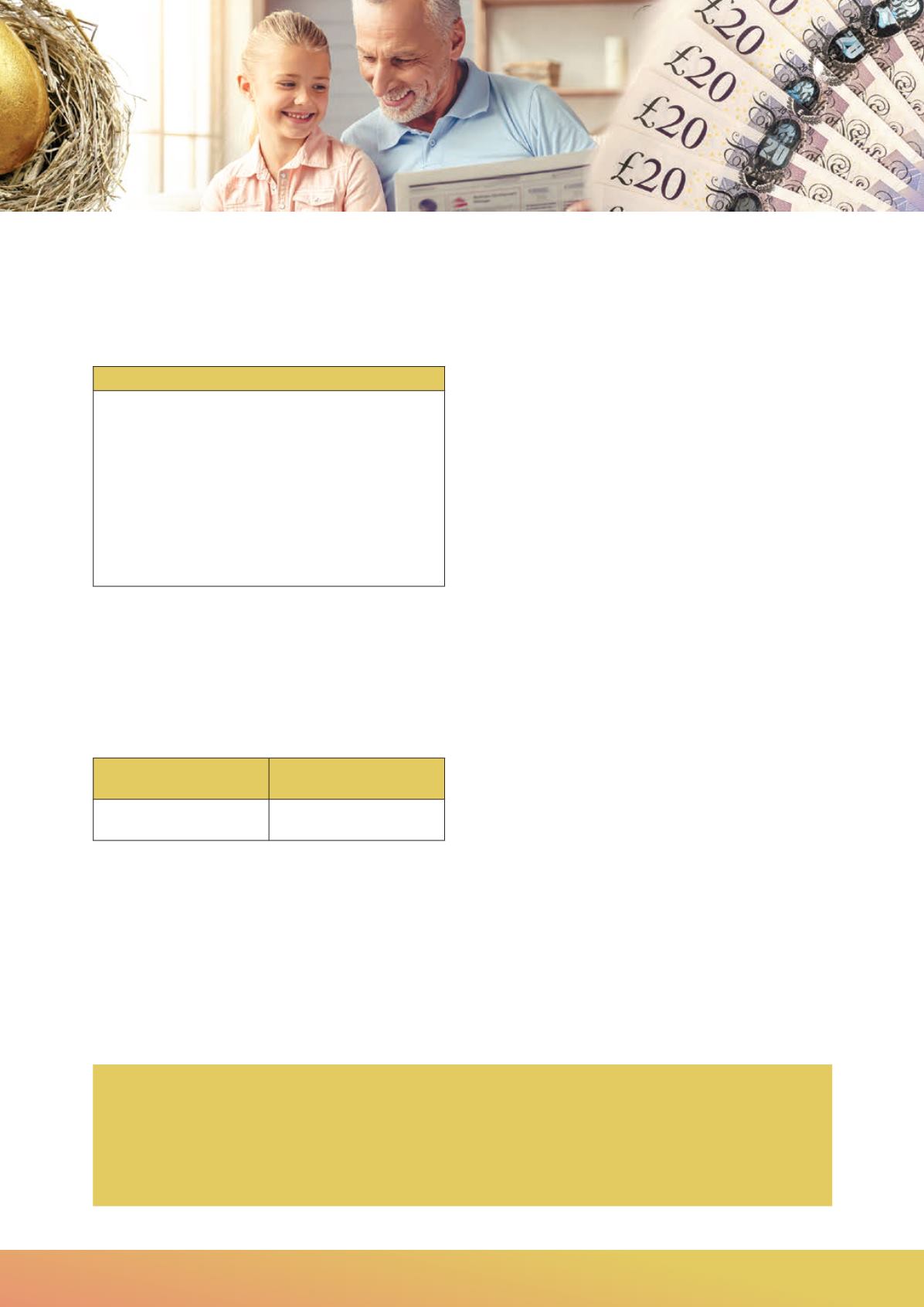

The lifetime allowance

Where total pension savings exceed the £1,030,000 lifetime

allowance at retirement (and fixed, primary or enhanced

protection is not available) a tax charge arises:

Tax charge

(excess paid as annuity)

Tax charge

(excess paid as lump sum)

25% on excess value, then up

to 45% on annuity

55% on excess value

The lifetime allowance will increase each year in line with CPI.

Accessing your personal pension fund

Taxpayers have the option of taking a tax-free lump sum of

25% of the fund value and purchasing an annuity with the

remaining fund, or opting for income drawdown which offers

further flexibility in how the fund is used.

An annuity is taxable income in the year of receipt. Similarly any

monies received from the income drawdown fund are taxable

income in the year of receipt.

Taxpayers have total freedom to access a pension fund from

the age of 55. Access to the fund may be achieved in one of

two ways:

• allocation of a pension fund (or part of a pension fund) into

a 'flexi-access drawdown account' from which any amount

can be taken, over whatever period the person decides

• taking a single or series of lump sums from a pension fund

(known as an 'uncrystallised funds pension lump sum').

When an allocation of funds into a flexi-access account is made

the member typically will take the opportunity of taking a

tax-free lump sum from the fund.

The person will then decide how much or how little to take from

the flexi-access account. Any amounts that are taken will count

as taxable income in the year of receipt.

Access to some or all of a pension fund without first allocating

to a flexi-access account can be achieved by taking an

uncrystallised funds pension lump sum. The tax effect will be:

• 25% is tax-free

• the remainder is taxable as income.

Money Purchase Annual Allowance

The government is alive to the possibility of people taking

advantage of the flexibilities by 'recycling' their earned income

into pensions and then immediately taking out amounts from

their pension funds. The MPAA sets the maximum amount of

tax-efficient contributions an individual can make in certain

scenarios. The allowance is set at £4,000 per annum, with no

carry forward of the allowance to a later year if not used in the

year.

The main scenarios in which the reduced annual allowance is

triggered are if:

• any income is taken from a flexi-access drawdown account,

or

• an uncrystallised funds pension lump sum is received.

However just taking a tax-free lump sum when funds are

transferred into a flexi-access account will not trigger the

MPAA rule.

Your next steps: contact us to discuss…

•

Calculating how much you need to save to ensure

you enjoy a comfortable retirement

•

Tax-advantaged saving for your pension

•

Saving in parallel to provide more readily accessible

funds

•

Saving in employer and personal pension schemes

•

Using your business to help fund your retirement