20

Tax-efficient estate planning

Keeping inheritance tax to a minimum

An estate plan that minimises your tax liability is essential.

The more you have, the less you should leave to chance. If

your estate is large it could be subject to inheritance tax (IHT),

which is currently payable where a person’s taxable estate is in

excess of £325,000. However, even if it is small, planning and

a well-drafted Will can help to ensure that your assets will be

distributed in accordance with your wishes. We can work with

you to ensure that more of your wealth passes to the people

you love, through planned lifetime gifts and a tax-efficient Will.

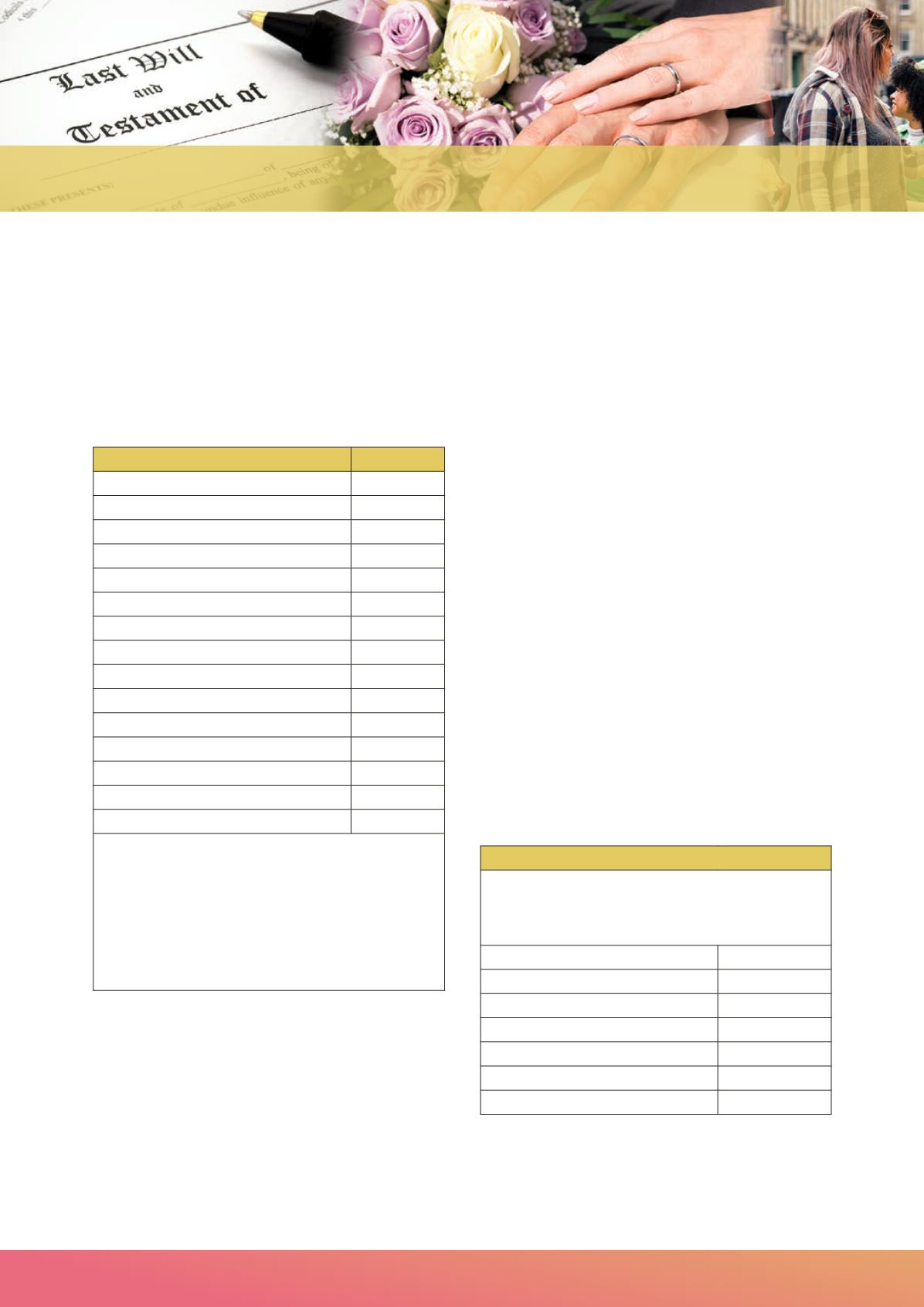

Estimate the tax on your estate

£

Value of

: Your home (and contents)

Your business

1

Bank/savings account(s)

Stocks and shares

Insurance policies

Other assets

Total assets

Deduct: Mortgage, loans and other debts

Net value of assets

Add: Gifts in last seven years

2

Less: Legacies to charities

Deduct: Nil-rate band

– 325,000

Deduct: Residence nil-rate band

Taxable estate £

Tax at 40%/36%

3

is £

1. If you are not sure what your business is worth, we can help

you value it. Most business assets currently qualify for IHT

reliefs

2. Exclude exempt gifts (eg. spouse, civil partner,

annual exemption)

3. IHT rate may be 36% if sufficient legacies left to charities

(see later). The tax on gifts between 3 and 7 years before

death may benefit from a taper relief.

Making a Will

If you own such possessions as a home, car, investments,

business interests, retirement savings or collectables,

then you need a Will. A Will allows you to specify who will

distribute your property after your death, and the people

who will benefit. Many individuals either do not appreciate its

importance, or do not see it as a priority. However, if you have

no Will, your property could be distributed according to the

intestacy laws.

You should start by considering some key questions:

Who?

Who do you want to benefit from your wealth? What

do you need to provide for your spouse? Should your children

share equally in your estate – does one or more have special

needs? Do you wish to include grandchildren? Would you like to

give to charity?

What?

Should your business pass to all of your children, or only

to those who have become involved in the business, and should

you compensate the others with assets of comparable value?

Consider the implications of multiple ownership.

When?

Consider the age and maturity of your beneficiaries.

Should assets be placed into a trust restricting access to income

and/or capital? Or should gifts wait until your death?

Making use of lifetime exemptions

You should ensure that you make the best use of the available

lifetime IHT exemptions, which include:

• the £3,000 annual exemption

• normal expenditure gifts out of after tax income

• gifts in consideration of marriage (up to specified limits)

• gifts you make of up to £250 per person per annum

• gifts to charities

• gifts between spouses, facilitating equalisation of estates

(special rules apply if one spouse is non-UK domiciled).

Spouses and civil partners

On the first death, it is often the case that the bulk of the

deceased spouse’s (or civil partner’s) assets pass to the survivor.

The percentage of the £325,000 nil-rate band not used on the

first death is added to the nil-rate band for the second death.

Case Study

Chris and Hilda were married. Chris died in May 2008, leaving

£50,000 to his more distant family but the bulk of his estate

to Hilda. If Hilda dies in 2018/19 her estate will qualify for a

nil-rate band of:

Nil-rate band on Chris’s death

£312,000

Used on Chris’s death

£50,000

Unused band

£262,000

Unused percentage

83.97%

Nil-rate band at the time of Hilda’s death

£325,000

Entitlement

183.97%

Nil-rate band for Hilda’s estate

£597,902

If you die within seven years of making substantial lifetime

gifts, they will be added back into your estate and may result

in a significant IHT liability. You can take out a life assurance

policy to cover this tax risk if you wish. However, you can make