14

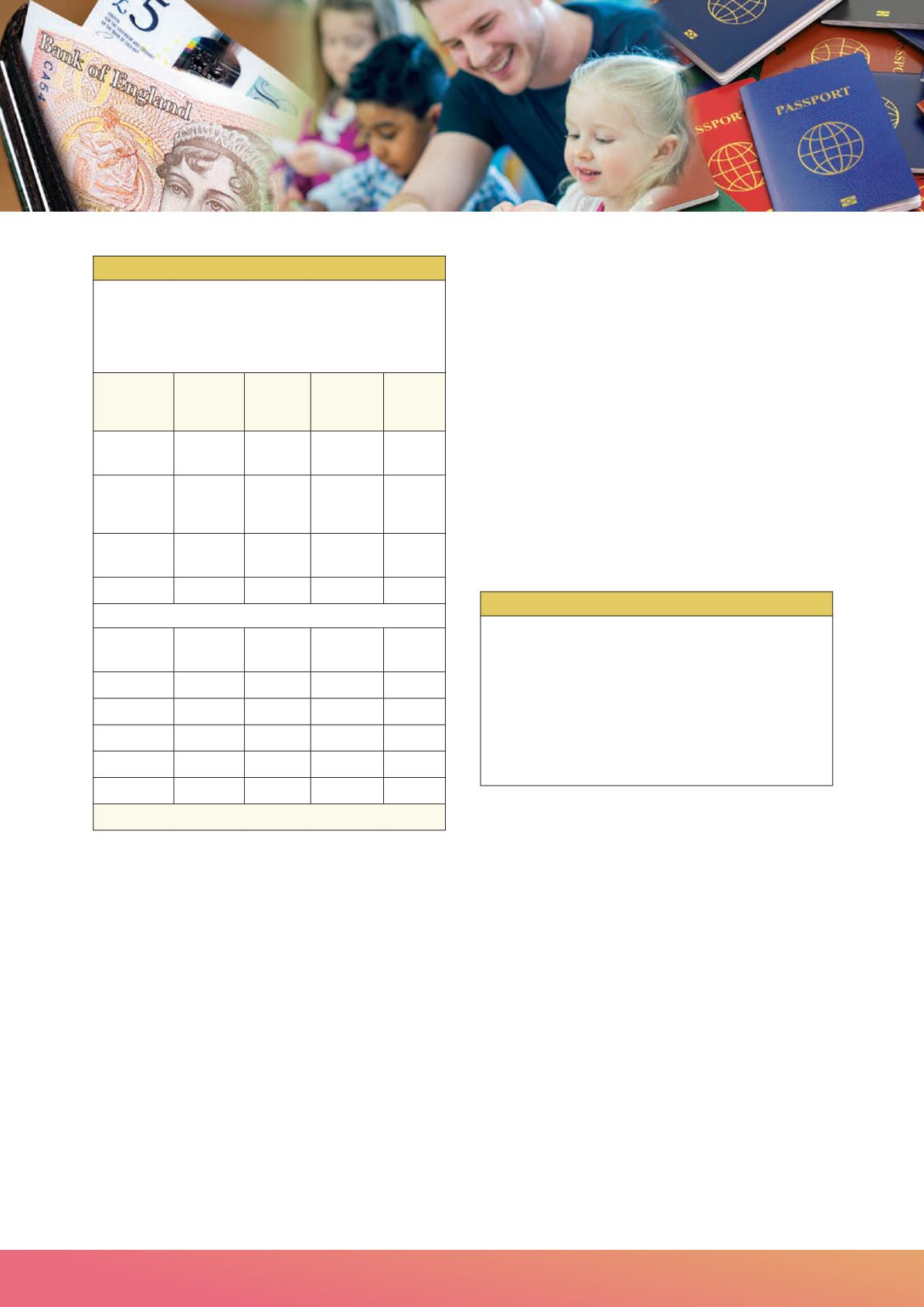

Case Study

Sandra is a single person with a gross 2018/19 income of

£56,000 (made up of £26,000 earnings, £5,000 of interest

and UK dividends of £25,000) and capital gains of £15,000

(assuming no other reliefs, etc). She would have a tax liability

of £8,528.

Earnings

£

Interest

£

UK

Dividends

£

Gains

£

Income and

gains

26,000 5,000 25,000 15,000

Deduct:

Personal

allowance

– 11,850

Deduct: CGT

exemption

–11,700

Taxable

14,150 5,000 25,000 3,300

Tax at:

0% the PSA

and DTA

0

500

2,000

20% on

14,150 4,500

7.5% on

13,350

32.5% on

9,650

20% on

3,300

Totals

£2,830.00 £900.00 £4,137.50 £660.00

Total tax liability £8,527.50

Transferring assets

Planning can be hindered by the potential for tax charges to

arise when assets are moved between members of the family.

Most gifts are potentially taxable as if they were disposals

at market value, with a resulting exposure to CGT and IHT.

However, special rules govern the transfer of assets between

spouses. In many cases for both CGT and IHT there is no tax

charge, but there are some exceptions – please contact us for

further advice. In addition, gifts must be outright to be effective

for tax, and must not comprise a right only to income. Careful

timing and advance discussion with us are essential.

The ‘hidden’ 45% and 60% tax rates

The top rate of income tax, for those with taxable income in

excess of £150,000, is 45% (38.1% for dividends). The PA is

scaled back if ‘adjusted net income’ exceeds £100,000, being

reduced by £1 for every £2 of income in excess of that limit.

This means that an individual with total taxable income of

£123,700 or more will not be entitled to any PA. This gives

an effective tax rate on this slice of income of 60%. It may

be possible to reduce your taxable income and retain your

allowances, if approached with due consideration, eg. by

making pension contributions or Gift Aid donations. Contact us

now for advice on minimising the impact of the top tax rates.

High Income Child Benefit Charge

A charge arises on a taxpayer who has adjusted net income over

£50,000 in a tax year where either they or their partner are in

receipt of Child Benefit for the year. Where both partners have

adjusted net income in excess of £50,000 the charge applies to

the partner with the higher income.

The income tax charge applies at a rate of 1% of the full Child

Benefit award for each £100 of income between £50,000 and

£60,000. The charge on taxpayers with income above £60,000

will be equal to the amount of Child Benefit paid. Claimants may

elect not to receive Child Benefit if they or their partner do not

wish to pay the charge. Equalising income can help to reduce

the charge for some families.

Case Study

Mark and Elizabeth have two children and receive £1,789

Child Benefit for 2018/19. Elizabeth has little income. Mark

expects his adjusted net income to be £55,000. On this basis

the tax charge will be £895. This is calculated as £1,789 x 50%

(£55,000 - £50,000 = £5,000/£100 x 1%).

If Mark can reduce his income by a further £5,000 no

charge would arise. This could be achieved by transferring

investments to Elizabeth or by making additional pension or

Gift Aid payments.

Cap on reliefs

There is a ‘cap’ on certain otherwise unlimited tax reliefs

(excluding charitable donations) of the greater of £50,000 and

25% of your income. This cap applies to relief for trading losses

and certain types of qualifying interest.

Giving your children a good start

Funding university and saving up a deposit for a first home

are increasingly expensive prospects, so the sooner you start

planning, the better. All children have their own PA, so income

up to £11,850 escapes tax this year, as long as it does not

originate from parental gifts. If income from parental gifts

exceeds £100 (gross), the parent is taxed on it unless the child

has reached 18, or married. Parental gifts could be invested

to produce tax-free income, or in a Cash or Stocks and Shares

Junior Individual Savings Account (JISA) to help build a fund to

help offset university expenses and minimise debts. The £100

limit does not apply to gifts into JISAs or National Savings

Children’s Bonds.