PROPERTY TAXES

The incremental rate of tax is only payable on the part of the property price

within

each band.

An additional 3% rate applies to certain second properties above £40,000 for all

3 taxes.

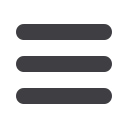

England, Wales and Northern Ireland

–

stamp duty land tax

From22November2017 (reverts to land transaction tax inWales from

1April2018).

On the transfer of

residential property

On the transfer of

non-residential property

£0 – £125,000

0%

Less than £150,000

0%

£125,001 – £250,000

2% £150,001 – £250,000 2%

£250,001 – £925,000

5%

Over £250,000

5%

£925,001 – £1.5m

10%

Over £1.5m

12%

First-time buyers pay nothing on the irst £300,000 and then 5% on the next

£200,000. If the property is over £500,000, the rates in the table above apply.

For purchases by companies and other non-natural persons in excess of

£500,000 a rate of 15% applies, subject to certain exclusions.

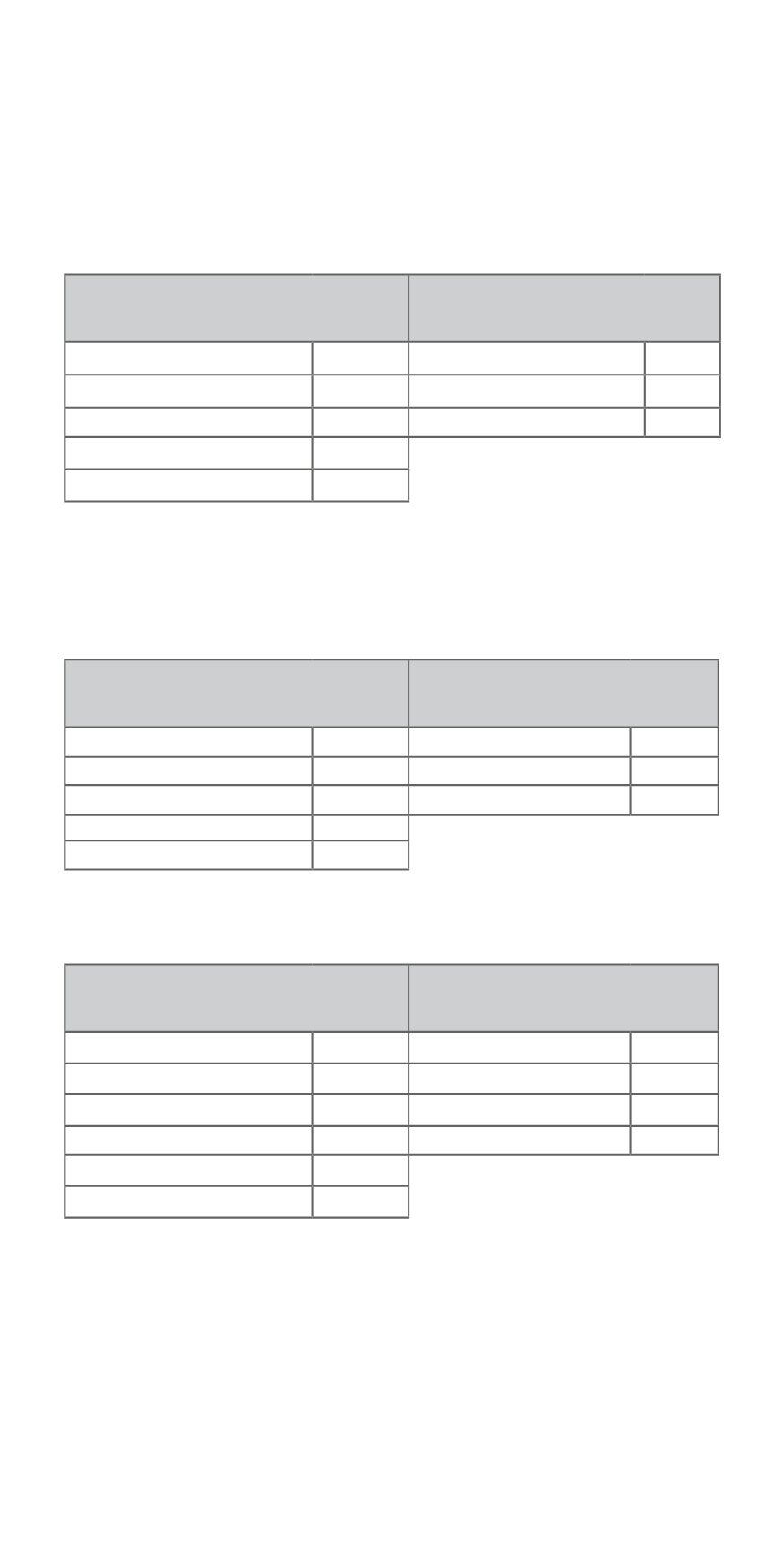

Scotland

–

land and buildings transaction tax

On the transfer of

residential property

On the transfer of

non-residential property

£0 – £145,000

0% £0 – £150,000

0%

£145,001 – £250,000

2% £150,001 – £350,000 3%

£250,001 – £325,000

5%

Over £350,000

4.5%

£325,001 – £750,000

10%

Over £750,000

12%

First-time buyers pay nothing on the first £175,000 from June 2018 (subject

to consultation).

Wales from 1 April 2018

–

proposed land transaction tax

On the transfer of

residential property

On the transfer of

non-residential property

£0 – £180,000

0% £0 – £150,000

0%

£180,001 – £250,000

3.5% £150,001 – £250,000 1%

£250,001 – £400,000

5% £250,001 – £1m 5%

£400,001 – £750,000

7.5%

Over £1m

6%

£750,000 – £1.5m

10%

Over £1.5m

12%