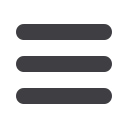

UK COMPANY TAXATION

Financial year from 1 April

2018

2017

Corporation tax rate

19%

19%

Loan to participators

32.5%

32.5%

Diverted proits tax

25%

25%

MAIN CAPITAL ALLOWANCES

Initial allowances

First-year allowance: for certain environmentally

beneicial equipment, new and unused electric and low

CO

2

emission cars (up to 50g/km)

100%

Annual investmentallowance:onirst£200,000(excludescars)

100%

Writing down allowances

Other plant and machinery

18%

Long-life assets, integral features of buildings,

thermal insulation

8%

Cars

51g/km – 110g/km

18%

Over 110g/km

8%

Patent rights and know-how – annual reducing balance

25%

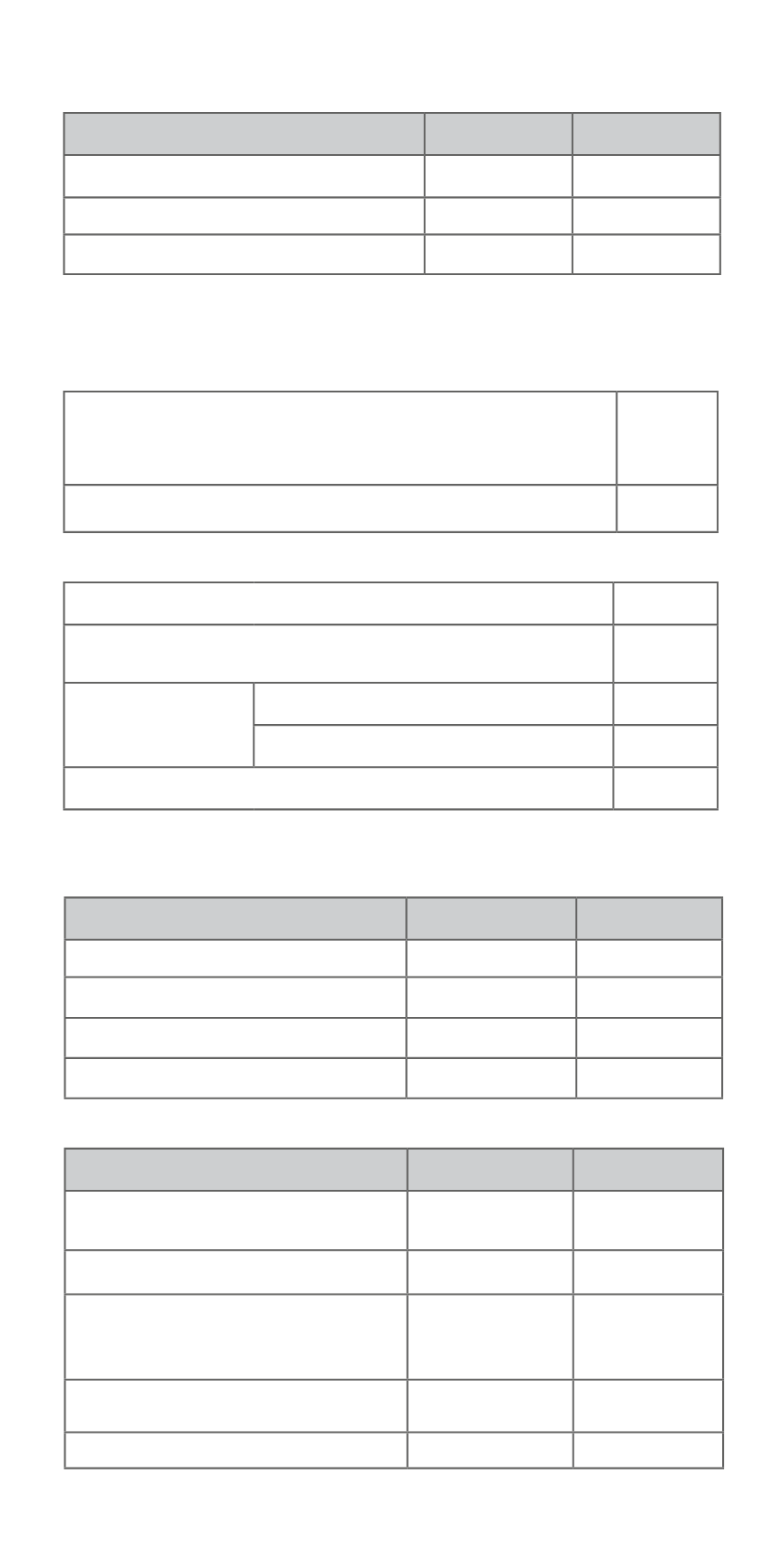

VALUE ADDED TAX

From 1 April

2018

2017

Standard rate

20%

20%

VAT fraction

1/6

1/6

Reduced rate e.g. on domestic fuel

5%

5%

VAT fraction

1/21

1/21

Taxable turnover limits

From 1 April

2018

2017

Registration (last 12 months or

next 30 days) over

£85,000

£85,000

Deregistration (next year) under

£83,000

£83,000

Registration for distance selling

into the UK (last 12 months or

next 30 days) over

£70,000

£70,000

Annual and cash accounting

schemes turnover limit

£1.35m £1.35m

Flat rate scheme

£150,000

£150,000