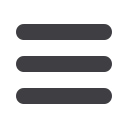

NATIONAL INSURANCE

Class 1

Employee

Employer

Earnings per week

Up to £162

nil* Up to £162

nil

From £162.01 to £892

12%

Over £162

13.8%**

Over £892

2%

Over state pension age

0%

Over state pension age

13.8%

* Entitlement to contribution-based beneits are retained for earnings between

£116 and £162 per week.

** 0% for employees under 21 and apprentices under 25 on earnings up to £892

per week.

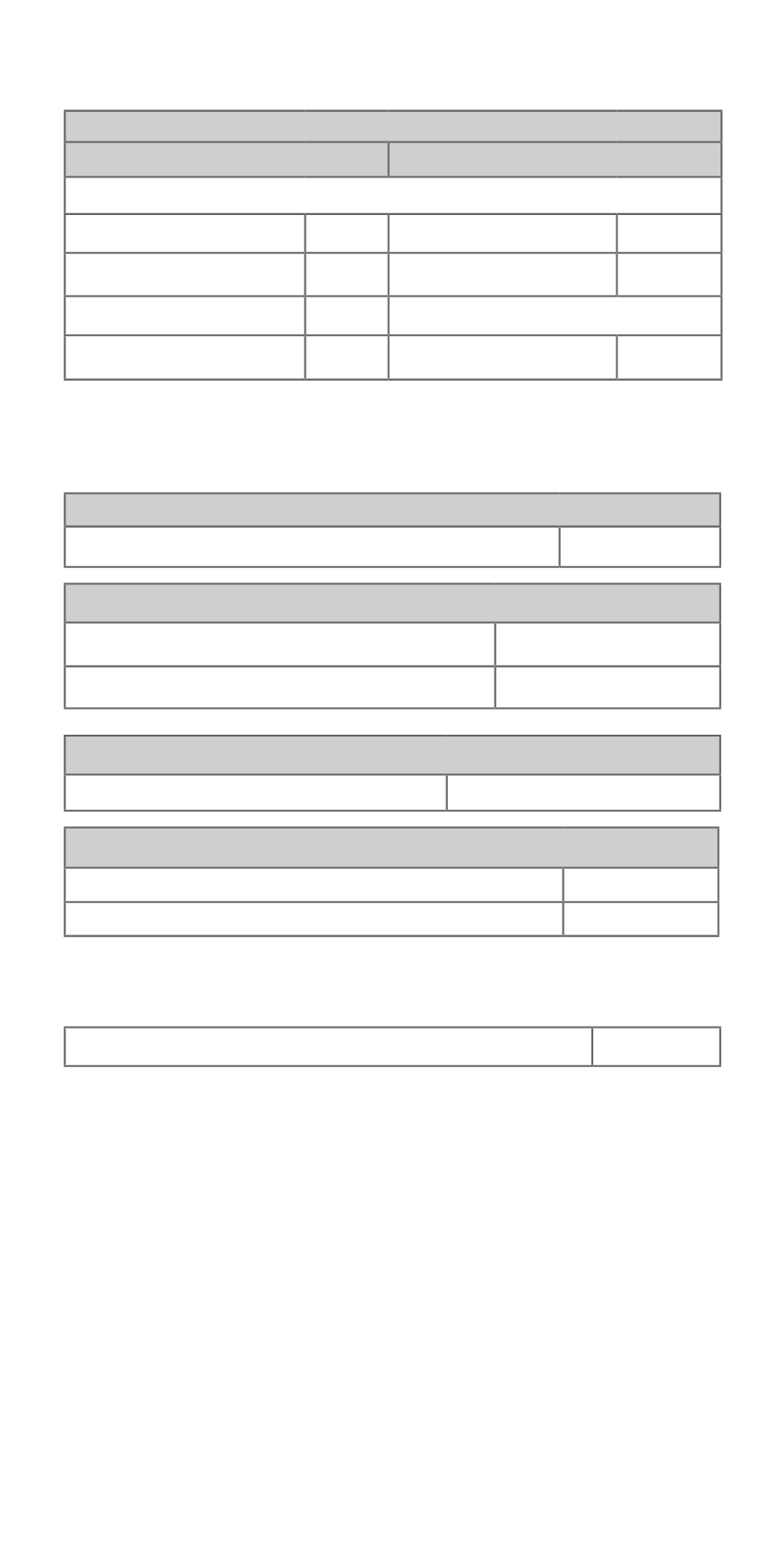

Class 1A

On relevant beneits, including car and fuel beneits

13.8%

Class 2

Self-employed above small proits threshold

£2.95 per week

Small proits threshold

£6,205 per annum

Class 3

Voluntary

£14.65 per week

Class 4*

Self-employed on proits £8,424 – £46,350

9%

Over £46,350

2%

* Exemption applies if the state retirement age is reached by 6 April 2018.

Employment allowance

Per employer, per year (excluding 1-person companies)

£3,000*

* 1 claim only for companies in a group or under common control. Not available

where the director is the only employee paid earnings above the secondary

threshold for class 1 national insurance contributions.

IMPORTANT NOTICE

These rates and allowances are based on autumn announcements made by

the UK and Northern Ireland, Scottish and Welsh governments and are for

information only. They are subject to change before 6 April and are subject to

conirmation by the various governments.

Rates apply to the UK and Northern Ireland unless indicated otherwise.

Apprenticeship levy

A levy of 0.5% applies where the pay bill exceeds £3m. There is an

allowance of £15,000. Further conditions apply so please consult with us.