5

Marriage breakdown

Maintenance payments do not usually qualify for tax relief. The

special CGT and IHT treatment for transfers between spouses

applies throughout the tax year in which a separation occurs.

For CGT, transfers in subsequent years are dealt with under

the rules for disposals between connected persons, with the

disposal treated as a sale at market value, which could result in

substantial chargeable gains. For IHT, transfers remain exempt

until the decree absolute.

Careful consideration as to the timing of such transfers is

essential. We can provide advice and assistance in this matter.

Planning for the worst

Proper contingency planning can help to ensure that your

spouse and/or children would be able to cope financially if you

died or were incapacitated.

One initial step might be to take out adequate insurance cover,

perhaps with life assurance written into trust for your spouse

or children to ensure quick access to funds. However, it is also

important to make a Will. We also strongly recommend that you

and your spouse:

•

Make a living Will (also called ‘advance decisions’):

so

that your wishes are clear with regard to medical treatment

in the event that, for example, you were seriously injured

following an accident

•

Execute a lasting power of attorney:

so that if you

become incapacitated and unable to manage your affairs,

whether as a result of an accident or illness, responsibility

will pass to a trusted person of your choosing.

On a practical note, make sure that you tell your spouse, your

parents, and your business partners where your Will and any

related documents are kept. It is your choice whether to discuss

your affairs in detail, but if you are passing on responsibility

for managing your affairs, it might be advisable to talk matters

through with them.

Checking for unclaimed assets

Billions of pounds worth of assets lie unclaimed in the UK. To

see if you have any lost assets contact the Unclaimed Assets

Register on 0844 481 8180 or visit

www.uar.co.uk.Please note

that a charge applies for this service. To find out whether you

have an unclaimed Premium Bond prize, call

0500 007 007

or

visit

www.nsandi.com.

Non UK domiciles: the current position

A UK resident and domiciled individual is taxed on worldwide

income and gains. Non UK domiciles who are UK resident

are currently able to claim the remittance basis of taxation in

respect of foreign income and gains. This means that they are

only taxed if foreign income and gains are brought into the

UK. The non UK domicile is also favourably treated for IHT as

they only pay IHT in respect of UK assets as opposed to their

worldwide assets.

New proposals for non UK domiciles

The Government intends to abolish non UK domicile status for

certain long term residents from April 2017. This will only apply

where an individual has been resident for at least 15 out of the

last 20 tax years. Such individuals will be treated as deemed UK

domiciled for all tax purposes.

In addition, those who had a domicile in the UK at the date of

their birth will revert to having a UK domicile for tax purposes

whenever they are resident in the UK, even if under general law

they have acquired a domicile in another country.

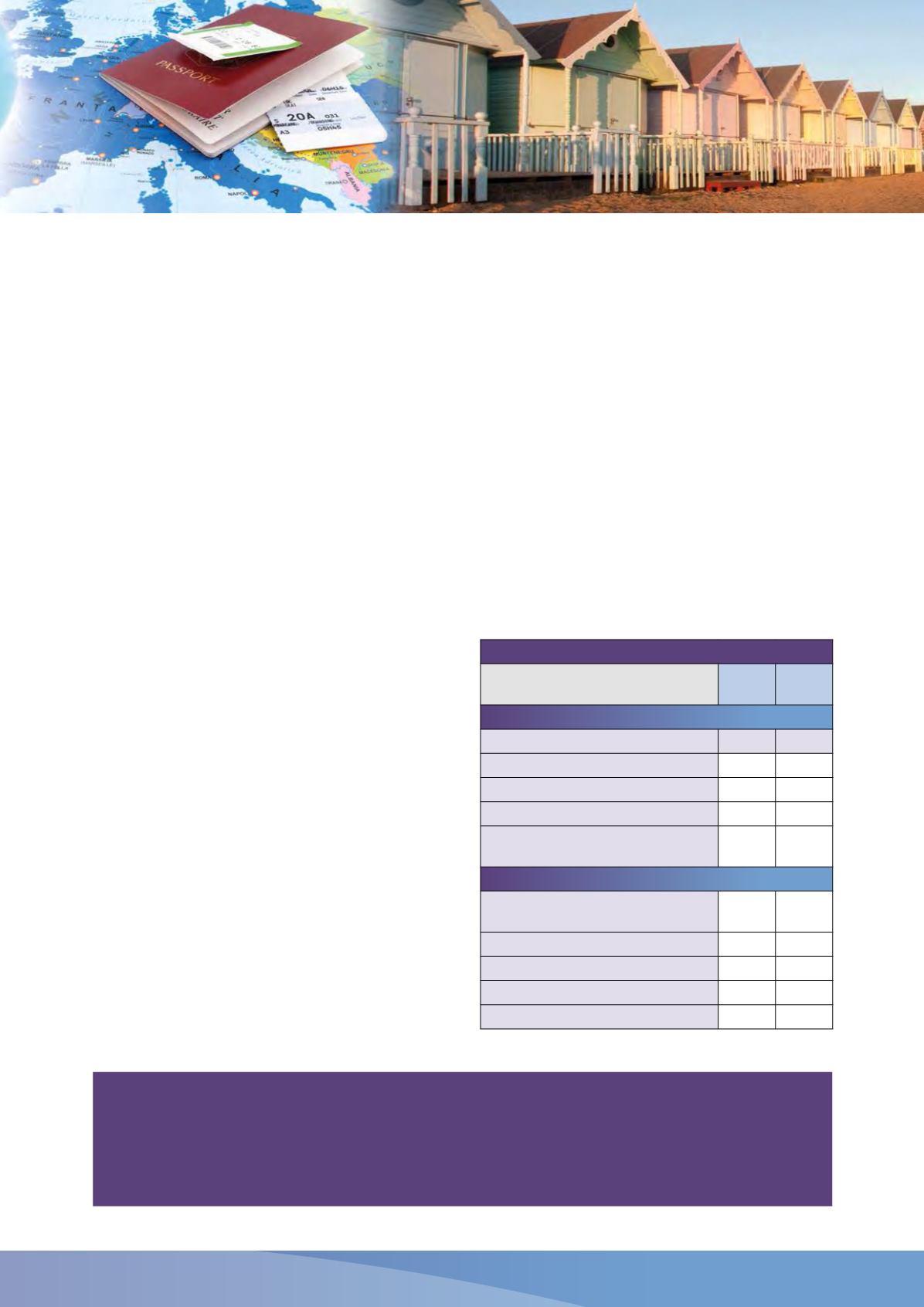

Checklist: Financial protection strategies

Self

✔

Spouse

✔

Essential:

Will

Living Will

Lasting power of attorney

Life assurance

Keep papers in a safe place – and make

sure other people know where they are!

Seriously consider:

Income, mortgage and loan protection

insurance

Tax-efficient estate planning

Planning for the transfer of your business

Funeral arrangements and expenses

A tax-efficient gift strategy

Next steps: contact us to discuss…

• Making the most of allowances and reliefs

• Ensuring that your tax liability is kept to a minimum

within the law

• Using savings, capital and other vehicles to give your

children a better start in life

• Writing a Will

• Life insurance and obtaining disability and critical

illness insurance

• Tax-efficient savings and investments