3

Strategies for you and your family

Reaching your financial goals

Every client is unique and will have particular financial needs

and goals. You might simply want to maximise your wealth so

that you can enjoy more of your hard-earned money now and in

retirement. You might need to pay for your children’s education,

or to help support ageing parents. Or perhaps all of the above

apply. As your accountants, we can suggest practical ways to

help make these objectives become reality.

Using exemptions and allowances

Each individual within your family is taxed separately, and is

entitled to his or her own allowances and exemptions. The

basic personal allowance for 2015/16 for those born after

5 April 1938 is £10,600, while the capital gains tax annual

allowance for 2015/16 is £11,100.

A series of rate bands and allowances are assigned first to your

earned income (which includes pensions), then to your savings

income, and finally to any UK dividend income.

Planning within the family

By using the available personal allowances and gains

exemptions, a couple and their two children could have income

and gains of at least £86,800 tax-free, and income up to

£169,540 before paying any higher rate tax. Through careful

tax planning, we could help you and your family to benefit from

more of your wealth.

Your tax planning objectives should include taking advantage

of tax-free opportunities, keeping marginal tax rates as low as

possible, and maintaining a spread between income and capital.

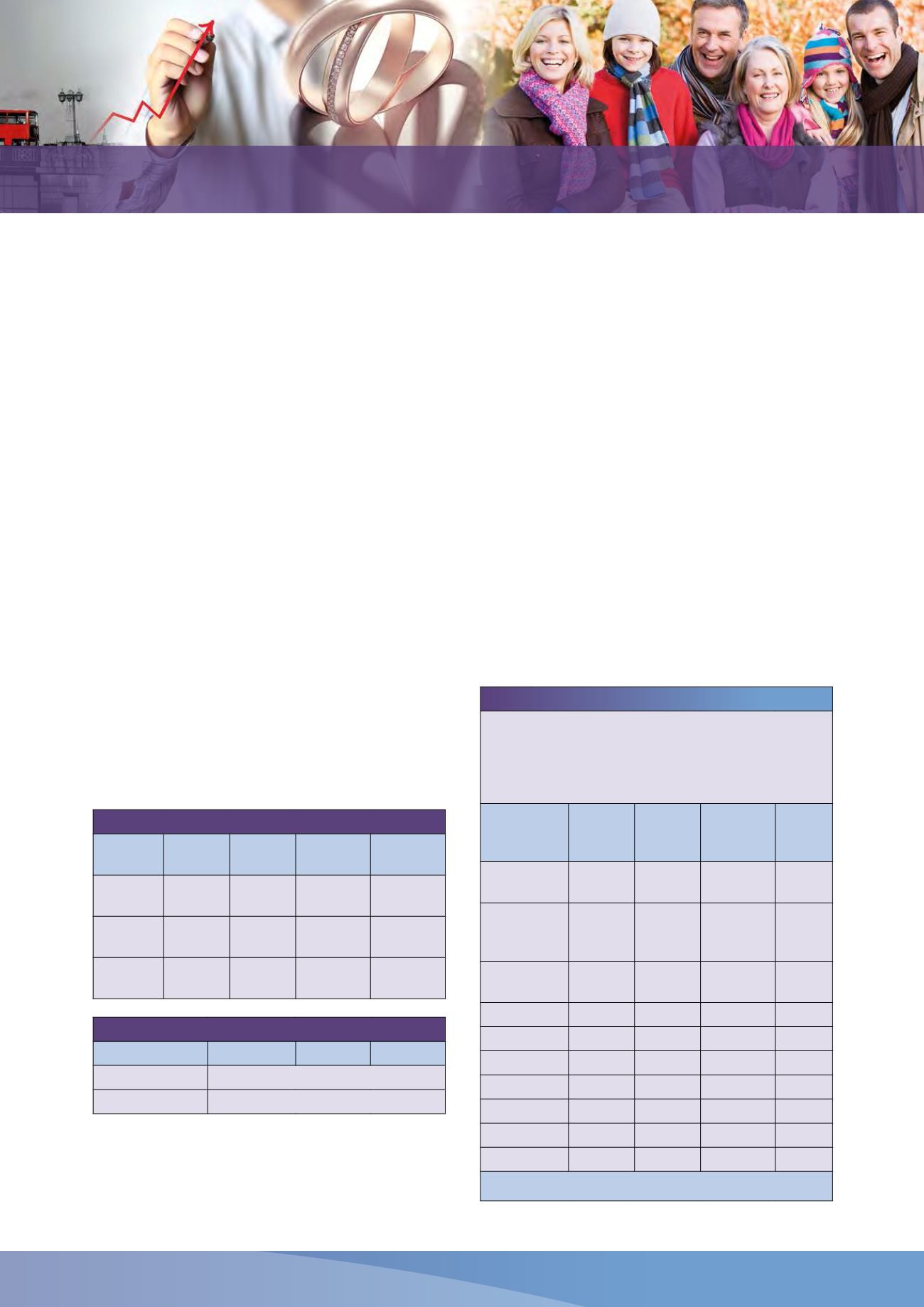

Income tax rates for 2015/16

Rate

Band

Taxable

Income

Earnings

etc

Savings Dividends

Basic

Up to

£31,785

20% 0%/20% * 10%

Higher

Over

£31,785

40% ** 40% ** 32.5% **

Additional

Over

£150,000

45% 45% 37.5%

Capital gains tax rates for 2015/16

Taxable Income Earnings etc Savings Dividends

First £11,100

Tax-free

Remainder

18%/28% ***

* There is a 0% starting rate for savings income up to the starting rate

limit (£5,000) within the basic rate band. Where taxable non-savings

income does not fully occupy the starting rate limit the remainder of the

starting rate limit is available for savings income.

** Personal allowance is reduced by £1 for every £2 that adjusted net

income exceeds £100,000. The effective marginal rate in this band is

60% (dividends 48.75%).

*** Depends on the level of income and gains.

Transferable Tax Allowance

From 6 April 2015 some married couples and civil partners are

eligible for a new Transferable Tax Allowance, enabling spouses

to transfer a fixed amount of their personal allowance to their

spouse. The option to transfer is available to couples where

neither pays tax at the higher or additional rate. If eligible, one

partner will be able to transfer 10% of their personal allowance

to the other partner (£1,060 for the 2015/16 tax year). For those

couples where one person does not use all of their personal

allowance the benefit will be up to £212 (20% of £1,060).

Starting rate of tax for savings income

From 6 April 2015, the maximum amount of an eligible

individual’s savings income that can qualify for the starting

rate of tax for savings is increased from £2,880 to £5,000, and

this starting rate is reduced from 10% to 0%. These rates are

not available if taxable non-savings income (broadly earnings,

pensions, trading profits and property income) exceeds the

starting rate limit.

Case Study

Ella is a single person with a gross 2015/16 income of

£45,600 (made up of £25,600 earnings, £5,000 of interest

and grossed up UK dividends of £15,000) and capital gains

of £11,200 (assuming no other reliefs, etc). She would have a

tax liability of £6,251.38.

Earnings

£

Interest

£

UK

Dividends

£

Gains

£

Income and

gains

25,600

5,000

15,000 11,200

Deduct:

Personal

allowance

– 10,600

Deduct: CGT

exemption

–11,100

Taxable

15,000

5,000

15,000

100

Tax at:

20% on

15,000

5,000

10% on

11,785

32.5% on

3,215

28% on

100

Totals

£3,000.00 £1,000.00 £2,223.38 £28.00

Total tax liability £6,251.38