Changes to the stamp duty payment window

The government has confirmed its plans to reduce the time limit for filing Stamp Duty Land Tax (SDLT) returns and

paying any tax due.

First announced in 2015, the measure was due to come into effect

in 2017/18, but was subject to a delay. The publication of the

draft Finance Bill 2018-19 in the summer has confirmed the plans.

The new timescales

SDLT is payable on the purchase of land and buildings in England

and Northern Ireland. Under the existing rules, purchasers currently

have 30 days from the effective date of the transaction (usually the

completion date) to file an SDLT return and pay the tax due.

Following the changes, for transactions with an effective date on

or after 1 March 2019, the time period for filing and paying tax will

be reduced to 14 days.

Separate rules apply in Scotland and Wales, where the Land

and Buildings Transaction Tax (LBTT) and Land Transaction Tax

(LTT) apply respectively. LBTT and LTT returns must currently be

made, and tax paid, within 30 days of the effective date of the

transaction.

Other considerations

The amount of duty payable depends on factors such as whether

the land or property is residential, non-residential, or of mixed

use. Non-residential property includes commercial property (such

as shops and offices); agricultural land; or six or more residential

properties bought in a single transaction. The current starting

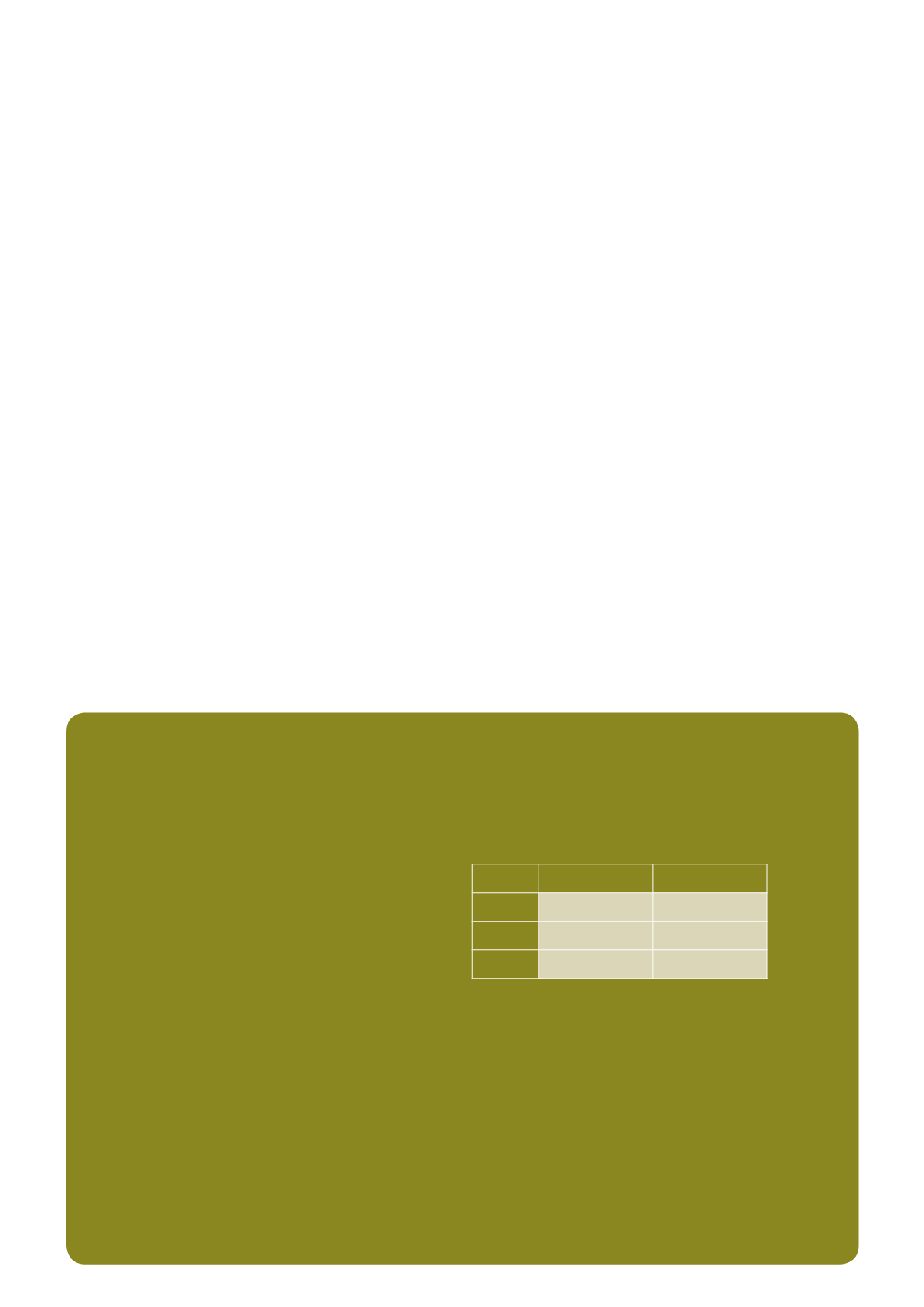

thresholds for SDLT, LBTT and LTT are as follows:

Residential

Non-residential

SDLT

£125,000

£150,000

LBTT

£145,000

£150,000

LTT

£180,000

£150,000

First-time buyers in England and Northern Ireland can benefit from

a new relief on the first £300,000 of residential purchases up to

£500,000, while a similar first-time buyer exemption can apply to

the first £175,000 of residential purchases in Scotland.

Across the UK, residential rates may be increased by 3% on the

purchase of additional residential properties. Although these are

targeted at second home owners and buy-to-let landlords, the

higher rates can also impact other purchasers. Care is therefore

needed if an individual owns or partly owns a property, and has

not disposed of the first before transacting to purchase a second.

This scenario may arise where, for example, there is a delay in

selling the main residence and a new purchase has completed.

We can advise on all areas of tax and property. Please

contact us for further assistance.

Data protection self-assessment: are you up-to-date?

25 May 2018 saw the introduction of a new data protection regime in the UK. As part of the changes, a new data

protection fee structure now applies, which replaces the previous requirement to register with the Information

Commissioner’s Office (ICO). Here, we consider the rules in more detail.

The regulations: an overview

On 25 May 2018, the Data Protection

(Charges and Information) Regulations 2018

came into effect, alongside the General Data

Protection Regulation (GDPR).

The GDPR has strengthened the obligations

on all organisations that deal with individuals

living in an EU member state to safeguard

the personal information belonging to those

individuals, and to retain verified proof of this

protection.

As part of the Data Protection (Charges and

Information) Regulations 2018, businesses

and individuals which process sensitive

information – regardless of their compliance

with the GDPR – must pay an annual data

protection fee to the ICO, unless they are

exempt. Exempt organisations are generally

those which:

y

y

manually process data

y

y

process data for personal, household or

family purposes

y

y

process data for the purpose of

maintaining a public register

y

y

handle data for staff administration

purposes

y

y

utilise data in order to advertise or market

the controller’s own activities

y

y

perform judicial functions

y

y

operate as a not-for-profit body, and

process data for specific purposes.

An exemption also exists for the purpose of

keeping accounts and records and making

financial forecasts, except where the data in

question was obtained from a credit reference

agency.

The new fee structure

Organisations and individuals which handle

personal information are termed ‘data

controllers’. It is data controllers who are

responsible for paying fees to the ICO.

A new fee structure has been introduced,

which replaces the previous requirement

to ‘notify’ (or register) under the Data

Protection Act 1998:

y

y

a Tier 1 fee of £40 is payable by micro

organisations with a maximum turnover of

£632,000, or no more than ten members

of staff

y

y

a Tier 2 fee of £60 is payable by small

and medium-sized organisations with a

maximum turnover of £36 million, or no

more than 250 employees

y

y

if you do not meet the criteria for Tier 1 or

Tier 2, the Tier 3 fee of £2,900 applies.

Controllers who have a current registration

under the 1998 Act do not need to pay the

new fee until their existing registration has

expired.

Any data controller who processes personal

data, or is responsible for the processing of

personal data, and either fails to pay a fee,

or fails to pay the correct fee, is breaking

the law and could be subject to significant

penalties. The maximum penalty is £4,350,

which equates to 150% of the top tier fee.

Ensuring you are compliant

The ICO provides a free self-assessment

tool:

https://bit.ly/2HFyNMM. It has also

developed a data protection self-assessment

toolkit specifically for small and medium-sized

enterprises, which contains assurance

checklists, alongside support in regard to the

security of information, direct marketing, the

management of records, data sharing, and

the data protection rules relating to CCTV.

Staying up-to-date with the data

protection regulations could help

you to avoid significant penalties.

FOR ELECTRONIC USE ONLY