Understanding dividends

For higher and additional rate

taxpayers the dividend and the

dividend tax credit are added

together and this figure is taxed

according to an individual’s income

tax band at the following rates:

•

higher rate: 32.5%

•

additional rate: 37.5%.

These taxpayers can reclaim the

dividend tax credit from the tax

due.

Comparing dividend tax

systems

The government hasn’t confirmed the full

details so it is not possible to fully assess the

impact of the changes at present. How the

£5,000 dividend tax allowance will work

with the personal allowance and dividend

tax rates is still an important, yet unconfirmed,

detail.

The following examples assume that:

•

dividends within the £5,000

allowance will count towards basic

and higher rate tax bands

•

the personal allowance for 2016/17

is £11,000

•

the basic rate limit for 2016/17 is

£32,000

•

the higher rate threshold for 2016/17

is £43,000

•

the people in the examples do not

receive any other income or dividends.

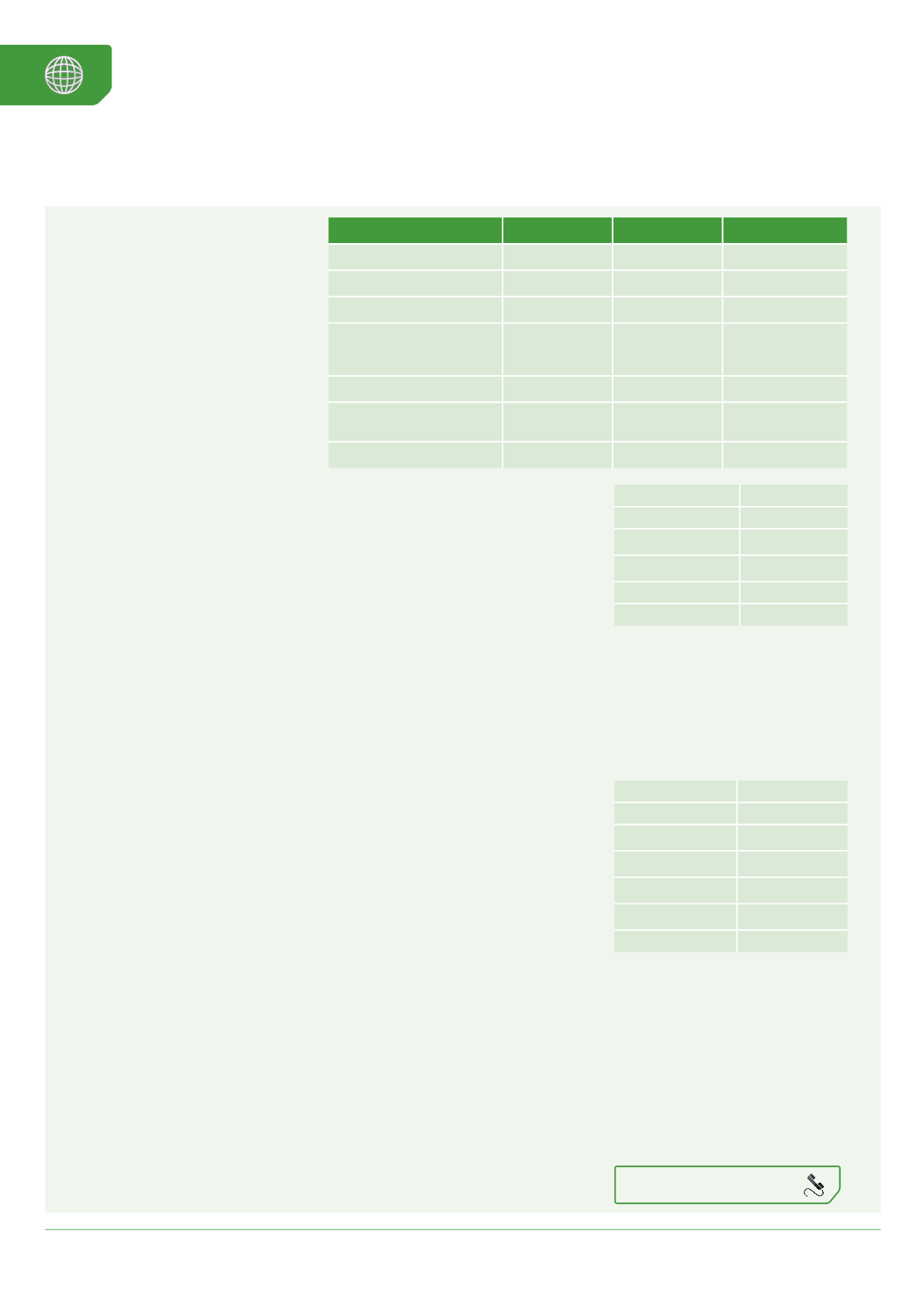

Non and basic rate

taxpayers

Hayley, John and Susan all receive £20,000

in dividends a year but have different salaries.

2015/16

None of the individuals pay tax on their

dividends under the current rules.

From April 2016

All of the individuals in these examples will

pay tax on their dividends from the 2016/17

tax year. However the amount of tax they will

pay will differ.

Hayley

The first £3,000 of Hayley’s dividends fall

within her remaining personal allowance and

as a result are tax-free. The next £5,000 of

dividends come under the annual dividend

allowance and are also tax-free. This leaves

£12,000 of dividend income that will be

taxed at the basic rate of 7.5%.

John

The first £5,000 of John’s dividends fall under

the annual dividend allowance and are

tax-free. This leaves £15,000 of dividend

income that will be taxed at the basic rate of

7.5%.

Susan

Susan’s situation is a little more complicated. All

of her salary falls within the personal allowance

and basic rate income tax band. She has not

used £3,000 of the basic rate allowance.

However, when the dividends are taken into

consideration, they push Susan’s total earnings

above the higher rate threshold, exposing a

proportion of her dividends to the higher rate of

tax at 32.5%.

The £5,000 dividend allowance is split in the

following way:

•

£3,000 ‘uses up’ Susan’s remaining

basic rate allowance

•

£2,000 falls under the higher rate.

The remaining £15,000 of dividends are taxed

at 32.5%.

Higher rate taxpayers

Pritesh earns £50,000 and receives £20,000

in dividends a year.

2015/16

As a higher rate taxpayer, Pritesh currently pays

32.5% tax on all his dividends and can reclaim

the tax credit.

From April 2016

Pritesh will pay less tax on his dividends

compared to 2015/16.

Although Pritesh earns £10,000 more

than Susan a year, they both pay the same

rate of tax on their dividends.

Minimising dividend tax

Until the exact details of the changes are

made public, approach any strategies to

minimise dividend tax with caution and

seek professional advice before making

any decisions.

Once the rules have been finalised, we

will be in a much stronger position to

advise on how the changes will affect you.

Dividend income £20,000

Tax credit

£2,222

Taxable dividend

income

£22,222

Tax

£22,222 x 32.5%

= (£7,222)

Tax credit

£2,222

Dividend after tax £15,000

Income

£50,000

Dividend income £20,000

Remaining personal

allowance

£0

Dividend allowance (£5,000)

Taxable dividend

income

£15,000

Tax

£15,000 x 32.5%

= (£4,875)

Dividend after tax £15,125

Hayley

John

Susan

Income

£8,000

£20,000

£40,000

Dividend income

£20,000

£20,000

£20,000

Remaining personal

allowance

(£3,000)

£0

£0

Dividend allowance

(£5,000)

(£5,000)

(£5,000)

£3,000 x 7.5 %

£2,000 x 32.5%

Taxable dividend income £12,000

£15,000

£15,000

Tax

£12,000 x 7.5%

= (£900)

£15,000 x 7.5%

= (£1,125)

£15,000 x 32.5%

= (£4,875)

Dividend after tax

£19,100

£18,875

£15,125

Talk to us about tax planning strategies.