2

Introduction

Alongside the wider challenges facing the economy, the UK tax system is also undergoing significant changes,

with the devolution of income tax and stamp duty powers to Scotland and Wales continuing apace. Meanwhile,

HMRC is continuing its drive towards a fully digital tax system, via its flagship Making Tax Digital regime. Here

we provide an overview of these latest developments.

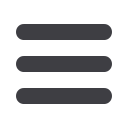

Changes to income tax

In the 2018/19 Scottish Budget, the Finance Secretary for

Scotland announced a raft of additional changes for Scottish

resident taxpayers, including new income tax rates, taking

the possible income tax rates payable up to five. For 2018/19

the tax rates and bands applicable to Scottish taxpayers on

non-savings and non-dividend income are set as follows:

Band £

Band Name

Rate %

0 - 2,000

Starter

19

2,001 - 12,150

Basic

20

12,151 - 31,580

Intermediate

21

31,581 - 150,000 Higher

41

Over 150,000

Top

46

From April 2019, the National Assembly for Wales has the right

to vary the rates of income tax payable by Welsh taxpayers.

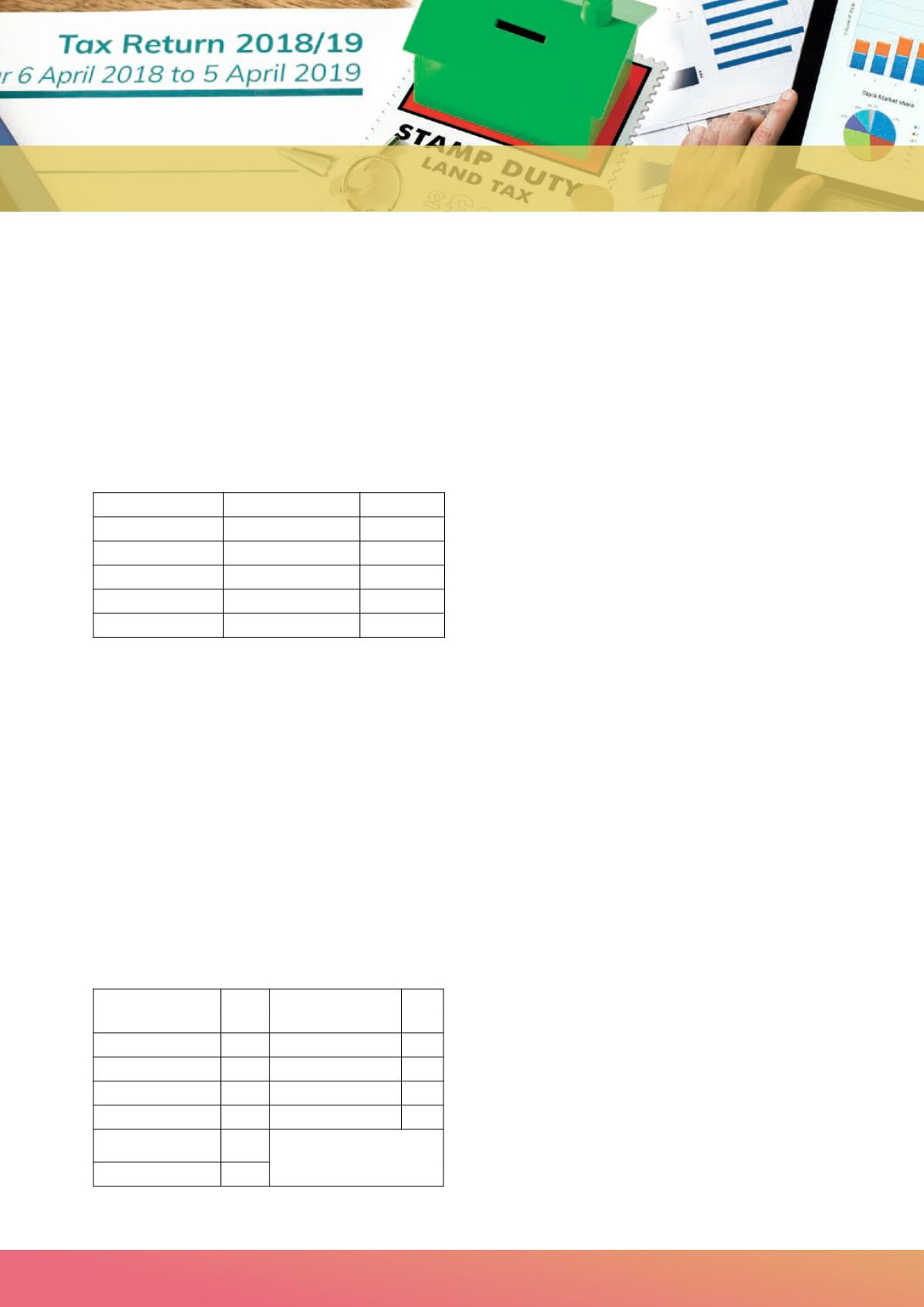

The new stamp duty regime

The stamp duty regime has also seen a number of significant

changes in recent times, and further measures take effect for

the 2018/19 tax year. From 22 November 2017, most first-time

buyers in England, Wales and Northern Ireland paying £300,000

or less for a residential property no longer pay Stamp Duty

Land Tax (SDLT), while those paying between £300,000 and

£500,000 pay SDLT at 5% on any purchase amount in excess of

£300,000.

From 1 April 2018, Wales rolls out its own stamp duty

equivalent, the Land Transaction Tax (LTT), which preserves

the essential structure of SDLT but with some key differences,

including a higher starting threshold for residential properties.

Wales has no plans to introduce a relief for first-time buyers. The

new LTT rates are as follows:

Residential

£

Rate

%

Non-residential

£

Rate

%

Up to 180,000

0

Up to 150,000

0

180,001 - 250,000 3.5 150,001 - 250,000 1

250

,001 - 400,000 5 250

,001 - 1,000,000 5

400,001 - 750,000 7.5

Over 1,000,000

6

750

,001 - 1,500,000 10

Over 1,500,000

12

Scotland already has its own equivalent of SDLT, the Land

and Buildings Transaction Tax (LBTT). In the Scottish Budget,

Finance Secretary Derek Mackay confirmed that the LBTT rates

will remain unchanged for 2018/19, although a new relief for

first-time homebuyers is planned.

Making Tax Digital: a look ahead

HMRC is phasing in its landmark Making Tax Digital (MTD)

initiative, which will see a fundamental change to the way in

which businesses keep records and report to HMRC, and will

ultimately require businesses and individuals to register, file, pay

and update their information via a secure online tax account.

The new system was originally intended to be implemented

between 2018 and 2020. However, following concerns raised by

business and industry experts, the government has put forward

a revised timescale for its introduction.

Under the new timetable, with effect from 1 April 2019

businesses with a turnover above the VAT threshold

(currently

£85,000) must keep digital records for VAT purposes and

provide their VAT return information to HMRC using MTD

functional compatible software.

Keeping digital records and making quarterly updates will not be

mandatory for taxes other than VAT before April 2020, although

businesses below the VAT threshold which have voluntarily

registered for VAT can opt to join the scheme.

MTD will ultimately affect all businesses, regardless of

their size. As your advisers, we are carefully monitoring the

latest developments and we can help you to prepare for the

new system.

Your financial planning strategy

In the face of ongoing change, it is more important than ever to

have in place a robust business and personal financial planning

strategy, to help ensure that you and your family are financially

secure and on course to achieve your long-term goals.

We can help with all of your business and personal tax and

financial planning needs. For a strategic review of your finances,

please contact us.