T O P I C A L I N F O R M A T I O N F R O M M A G E E G A M M O N

Email:

MG@MageeGammon.comWebsite:

www.MageeGammon.comHenwood House, Henwood, Ashford, Kent TN24 8DH Phone: 01233 630000

Principals:

Jon Gammon, Antony Tutt, Mark Britland, Abhi Jain, Roland Parry, Andy Childs

Managers:

David Brookes, Julie Devine, Dan Edwards, Linda Hayward, Peter Horton, Barry Spokes

Magee Gammon is a trading style of Magee Gammon Partnership LLP and Magee Gammon Corporate Limited.

Registered to carry on audit work in the UK and Ireland, and regulated for a range of investment business activities by the Institute of Chartered Accountants in England and Wales.

Staff Matters

We would like to welcome Dan Edwards

who has joined us as a Senior Manager.

Dan specialises in accounting and tax

for companies, partnerships and sole

traders and Solicitors Accounts Rules

examinations.

Welcome also goes to Fern Murphy who

has recently joined the team as a trainee

accountant and is studying for AAT

qualification.

MG NEWS

Changes to the Annual Investment Allowance:

getting the timing right

The Annual Investment Allowance (AIA) is due to

fall from £500,000 to £200,000 with effect from

1 January 2016. Transitional rules will have an impact

on the amount businesses can claim, so it is important

to plan ahead if you want to receive the maximum tax

benefit.

What is the AIA?

The AIA enables businesses to deduct the full cost of plant and

machinery (excluding cars) from their profits in the year of purchase.

It applies to businesses of any size and most business structures, but

there are provisions to prevent multiple claiming. Businesses are able

to allocate their AIA in any way they wish; so it is quite acceptable for

them to set their allowance against expenditure qualifying for a lower

rate of allowances (such as long life assets or integral features).

How much can I claim?

The AIA was temporarily increased to £500,000 from 1 April 2014

for companies or 6 April 2014 for unincorporated businesses,

until 31 December 2015. It had been due to fall to £25,000 from

1 January 2016. However, in his Summer Budget on 8 July, the

Chancellor announced that the AIA will instead be set at £200,000.

Accounting periods spanning the change

Where the accounting period spans 31 December 2015, the maximum

amount of AIA entitlement is calculated on a pro-rata basis.

For example, if Brown & Co’s accounting period begins on

1 April 2015 and ends on 31 March 2016, approximately three

quarters of that period would fall before the date of the change

(1 January 2016) and approximately one quarter would fall after

that date. Brown & Co will be subject to a transitional AIA maximum,

calculated as follows:

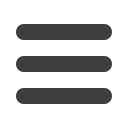

Dates

Fraction of

period

Allowance

for full year

Transitional

allowance

01/04/15 –

31/12/15

9/12

£500,000 £375,000

01/01/16 –

31/03/16

3/12

£200,000

£50,000

Transitional

AIA maximum

£425,000

Timing expenditure for maximum relief

As demonstrated in the above example, the maximum AIA for

expenditure incurred before 1 January 2016 is £425,000. However,

where expenditure is incurred on or after 1 January to 31 March 2016,

the maximum amount of relief will only be £50,000. Therefore, if you

want to gain the maximum benefit of the £500,000 AIA, it may be

advisable to purchase plant and machinery before 31 December 2015.

If this is not an option, you might want to delay expenditure until

after 31 March 2016, when the AIA will be set at £200,000. Note that

tax relief will have been deferred for a full year.

Careful consideration should be given to the timing of

any expenditure to ensure you are able to maximise the

available relief. Please speak to us for further advice.

Winter 2015/16 inside this issue…

u

u

Help to Buy: the ISA for first-time buyers

u

u

A five step plan for dealing with negative

reviews

u

u

Workplace conflict: resolving staff disputes

u

u

Business Round‑up

u

u

Web Watch

u

u

Reminders for your Winter Diary