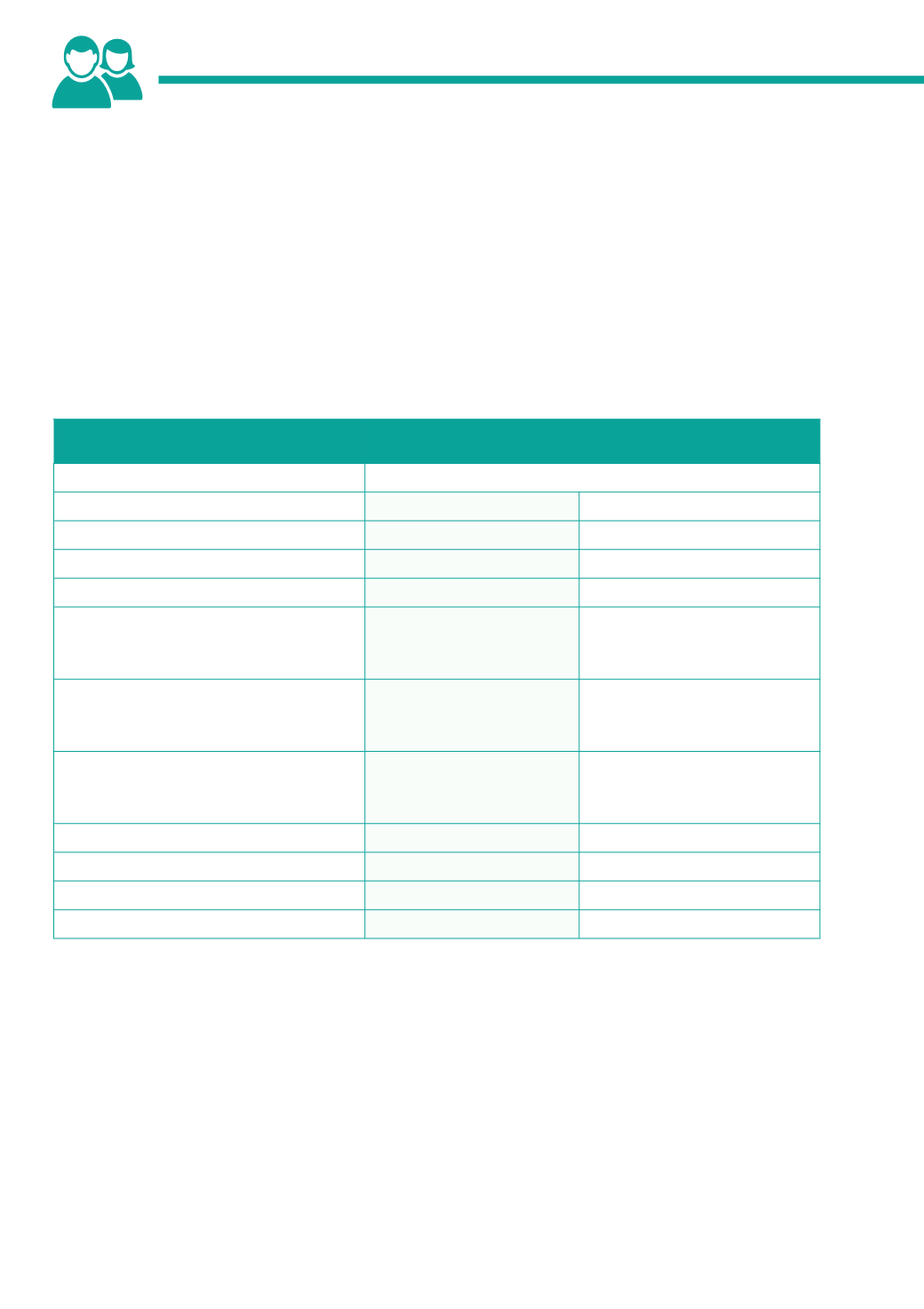

INCOME TAX

The personal allowance for 2016/17 increases by £400 to £11,000. The marriage allowance increases by £40 to £1,100.

If no further changes are announced the rates and allowances will be as follows:

Bands of taxable income

2015/16

2016/17

% of income/£ per year

Basic rate

20%

20%

Higher rate

40%

40%

Additional rate

45%

45%

Starting rate for savings income

0%

0%

Dividend ordinary rate – for dividends otherwise

taxable at the basic rate (effective rate with

tax credit)*

10% (0%)

7.5%

Dividend upper rate – for dividends otherwise

taxable at the higher rate (effective rate with

tax credit)*

32.5% (25%)

32.5%

Dividend additional rate – for dividends

otherwise taxable at the additional rate

(effective rate with tax credit)*

37.5% (30.6%)

38.1%

Starting rate limit (savings income)

£5,000

£5,000

Basic rate band

£0-31,785

£0-32,000

Higher rate band

£31,786-£150,000

£32,001-150,000

Additional rate band

Over £150,000

Over £150,000

*From April 2016 the dividend tax credit will be abolished and replaced with a new £5,000 tax-free dividend allowance.

TAX CREDITS

The forthcoming reduction in tax credits will be cancelled meaning that the tax credit taper rate and thresholds remain unchanged.

Tax credits will still be phased out as universal tax credit becomes the primary bene"t vehicle. The income rise disregard will be £2,500.

There are no further proposed changes to the universal credit taper, or to the work allowances beyond those that passed

through parliament.

5

//

Personal Announcements

PERSONAL

ANNOUNCEMENTS